History Is on the Side of Gold, Not Stocks

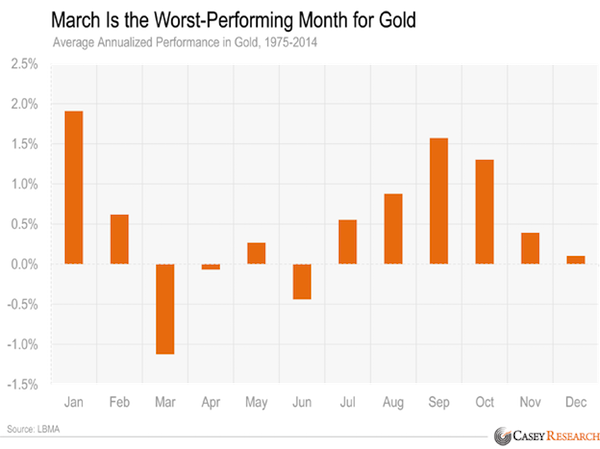

In a short article for Casey Research, Jeff Clark observes that the gold price has declined for eight consecutive days for the first time since 2009. However, investors shouldn’t worry too much. As the chart below shows, gold prices often cycle through a low point in March before picking up again.

Since 1975, March has been by far the worst month for gold. In other words, the current price behavior is normal for this time of year. In a world of growing currency manipulations and negative interest rates, it’s only a matter of time before we see the inevitable consequences of these actions. It won’t be pretty—but gold will be a refuge in that fallout. This tells us that gold’s current decline should be viewed as an opportunity to shore up our precious metals portfolios.”

Speaking of historical trends, what about the stock market? Gold is likely to reverse this March slump, but will the stock market continue on its multi-year bull run?

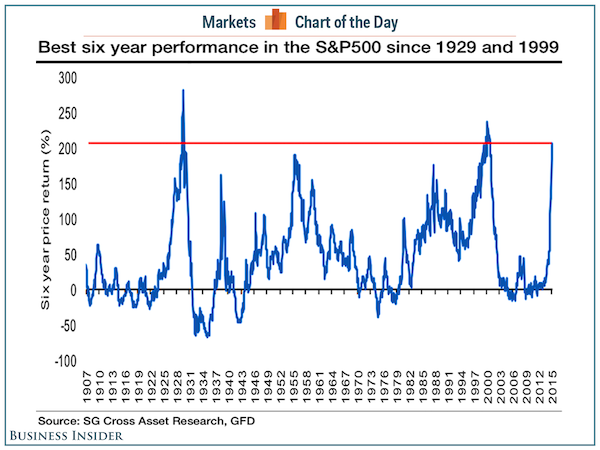

The S&P 500 has been growing for six straight years and is now up 200%. Wall Street couldn’t be happier, and many have high expectations that this trend will continue. The notion that stocks could be in a bubble is rarely entertained.

But take a look at the previous times the S&P enjoyed such remarkable gains. An analyst with Societe General charted the rolling 6-year returns of the S&P 500 beginning in 1907. Andrew Lapthorne writes:

Such a strong six year run up in US equities has only been seen twice since 1900, i.e., back in 1929 and 1999, neither of which ended well.”

“1929 and 1999 didn’t end well.” Talk about an understatement. Every investor is familiar with those years, which saw two of the worst stock market crashes in Western history. In the case of 1929, the crash ushered in the Great Depression — the worst economic downturn of the modern era. After looking at this chart, no cautious investor would deny that a massive bubble may already have formed.

So here you have two charts that should point investors back to the golden rule of investing — buy low, sell high. Everyone knows this mantra, but successfully executing it can be tricky at best. Perhaps this year, history can be a guide. The stock market might continue to rally for some time, but the evidence mounts daily that the ride can’t last much longer.

On the other hand, gold is experiencing the common March doldrums. What’s more, even with its drop in US dollars over the past few years, nothing has been able to push it below $1,100. Many analysts who are less caught up in the irrational exuberance of the equities markets strongly believe gold touched its bottom back in November. Now could be an excellent opportunity to buy.

What might reverse the fortunes of both gold and US equities? Peter Schiff believes it could be the realization that the Federal Reserve is not going to begin raising interest rates this summer.

Wall Street firmly believes that a real economic recovery is underway in the US, so stock speculators are more than willing to blindly trust in Janet Yellen’s promise of a rate hike. However, when that promise falls through, 2015 could become the next 1929 as the markets reevaluate the true strength of the American economy.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Leave a Reply