Gold Scarcity in Perspective as “Peak Gold” Looms

Of course, gold’s value lies in its scarcity.

But just how scarce is it, really? We all have a vague idea, but you will probably still find the reality quite shocking.

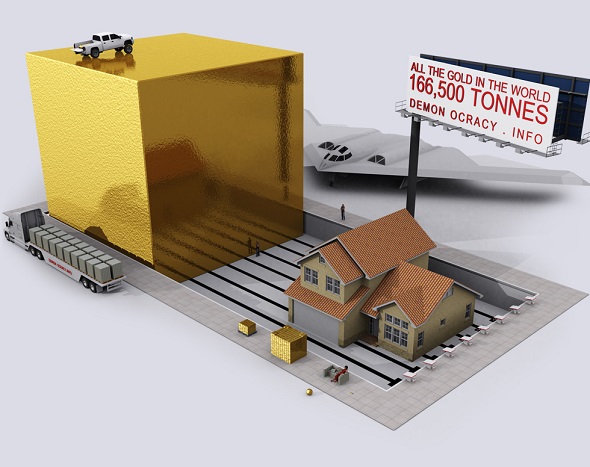

A series of 12 stunning visualizations of gold published by Visual Capitalists puts the rarity of gold into vivid perspective.

Demonocracy.info put together this series of 3D visualizations showcasing all of the world’s gold mined thus far using gold bullion bars. (Note: these visualizations are a couple of years old and optimistically have the value of gold pegged at $2,000 per ounce, presumably for the ease of calculations.)

If you stack all of the gold mined in history in the form of 400 ounce bars, it wouldn’t even reach to the of the Statue of Liberty’s waist. Melted down, it would fit into an Olympic-sized swimming pool.

Demonocracy.info put together similar visualizations for silver.

The scarcity of gold takes on greater significance considering we are likely nearing “peak gold.” In other words, the amount of gold mined out of the earth will begin to shrink every year, rather than increase, as it has since the 1970s.

Last year, Goldcorp CEO Chuck Jeannes announced the world will reach “peak gold” in 2014 or 2015.

As gold production declines, the miner’s job becomes harder, as companies compete for increasingly rare deposits. Discoveries have already tapered off. In 1995, 22 gold deposits with at least two million ounces of gold each were discovered, according to SNL Metals Economics Group. In 2010, there were six such discoveries, and in 2011 there was one. In 2012: nothing.”

Just last April, Goldman Sachs analysts predicted gold production would peak in 2015, saying there are “only 20 years of known mineable reserves of gold and diamonds.” The report warned that mineable reserves of rare commodities like gold may dwindle to extreme scarcity within two decades, meaning easily mined gold will continue to get harder and harder to find.

And as we reported last week, with many mining companies in the red, analysts expect gold production to drop for the first time since 2008.

Given all of this data, it appears the gold industry will soon enter a long-term — and possibly irreversible — period of less available gold. As mining companies find it more difficult to pull gold out of the earth, it will mean less gold for refiners to produce for the consumer market. Gold finds its value in its scarcity, and that scarcity looks like it will only increase.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Leave a Reply