Gold Price Hits 11-Week High; What to Expect This Week

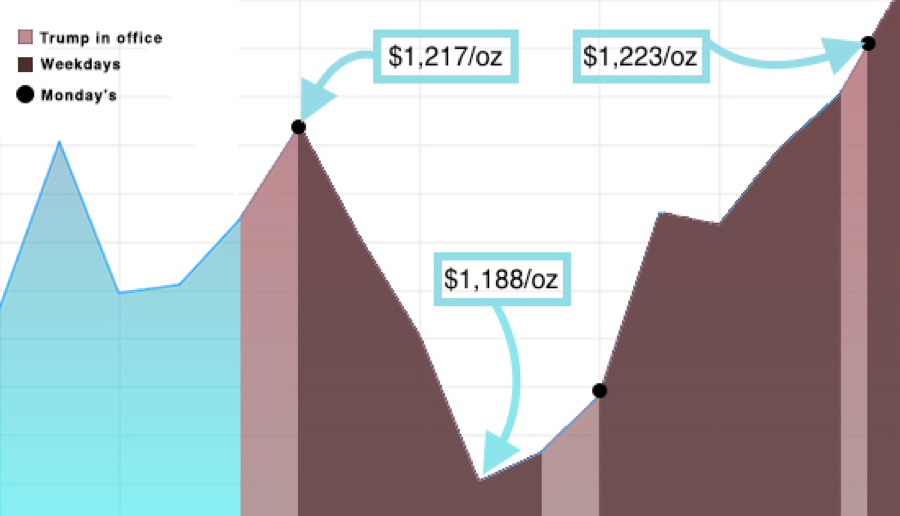

Gold hit an 11-week high, opening Monday at $1,223.50 and climbing steadily all morning. By the afternoon, it had risen another $12. Interest in gold was spurred by a weak dollar and last week’s mixed US jobs numbers that “muted expectations for near-term interest rate hikes,” according to Reuters.

A look at the past two weeks shows some volatility in gold prices, as Trump’s executive orders and FOMC meetings impacted market expectations for the future. Trump’s first week in office saw gold drop almost $30 after Trump announced changes to Obamacare and construction of the wall. Also impacting the price was the Dow’s record-breaking week hitting 20,000 points.

The beginning of Trump’s second week saw a much different response from investors coming off the travel ban and national protests. Anxieties over a weakening dollar and international reactions to the ban fueled a move into safe haven assets like gold and silver.

The FOMC’s monthly meeting kept prices stable until the announcement Wednesday that they would pass on another chance to raise interest rates, which began the steady climb in the price of gold that’s carried over from the weekend and continues today.

The latest political battle for Trump began with his executive orders last Friday to scale back financial regulations by overhauling Dodd-Frank. The changes are likely to include the Volcker Rule, which concerns making certain kinds of speculative investments that do not benefit their customers and removable of the DOL’s fiduciary rule, which ensured financial advisors worked in the interests of their clients.

Deregulation is always a good thing, and the Dodd-Frank overhaul has strong Republican support. However, Trump hasn’t shown a particular knack for successfully rolling out new policies, and investors are likely to wait longer for signs of success before pricing in the deregulation, which is likely to send asset markets and the dollar higher.

Get Peter Schiff’s latest gold market analysis ñ click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]