Gold Defies Headwinds; Demand Surges in Last Half of 2015

After a tepid first half of 2015, demand for gold rallied during the last half of the year, despite a number of economic and external factors working against it.

According to the World Gold Council’s Gold Demand Trends Full Year 2015 a surge in demand during the fourth quarter turned around what was looking to be a bad year for the yellow metal:

Gold demand in the fourth quarter increased 4% year-on-year to a 10-quarter high of 1,117.7 tons. Full year demand was virtually unchanged…Weakness in the first half of the year was cancelled out by strength in the second half. Fourth quarter growth was driven by central banks (+33 tons) and investment (+25 tons).”

According to the WGC report, a number of external factors contributed to the slow start for gold in 2015. Extreme adverse weather patterns buffeted Indian demand for jewelry, and an economic slowdown combined with financial market turbulence hit demand in China. But things rebounded in both Asian nations during the second half of the year.

Demand in China ticked up 3% in the fourth quarter year-on-year. The improvement was primarily driven by demand for investment bars and coins. Retail sales in China were up 11% in December and 11.2% in November. According to the WGC report, the Chinese are buying gold for its historical role as a safe haven:

The weakness of the domestic currency was cited as a main driver of demand for gold bars and coins, with consumers seeking gold’s wealth protection properties.”

India saw an even more robust demand increase in Q4, growing 6% despite significant obstacles:

Total Indian demand for jewelry, bars, and coins expanded by 6% year-on-year (+14 tons) to 233.2 tons in the fourth quarter. Although traditionally one of the strongest quarters for gold demand in India (as the festival and wedding season gets underway) large parts of Southern India had major difficulties to contend with. Chennai was battered by heavy rainfall and flooding, while falling rubber prices and lower investment from the sizable expat population based in the Middle East hit incomes in Kerala. In Telangana, rural incomes weakened after the deficient monsoon curtailed output of rice and cotton.”

In fact, the World Gold Council called the worldwide consumer demand increase in Q4 surprising given the underlying factors working against it:

The resilience of consumer demand in the fourth quarter was somewhat surprising, given inhospitable economic, climatic and socio-political conditions in a large number of markets…India and China were the mainstays of the market, despite facing some not insignificant hurdles. But growth also came from some unexpected quarters, including Japan, Vietnam and Iran.”

Consumer demand in the US increased a healthy 6% during the fourth quarter of 2015. Gold bar and gold coin sales were robust during the last half of the year. Fourth quarter demand spiked 15% year-on-year. It was the strongest Q4 since 2011, when demand was still elevated by global economic weakness. Annually, US investment demand jumped by 53% to 73.2 tons in 2015.

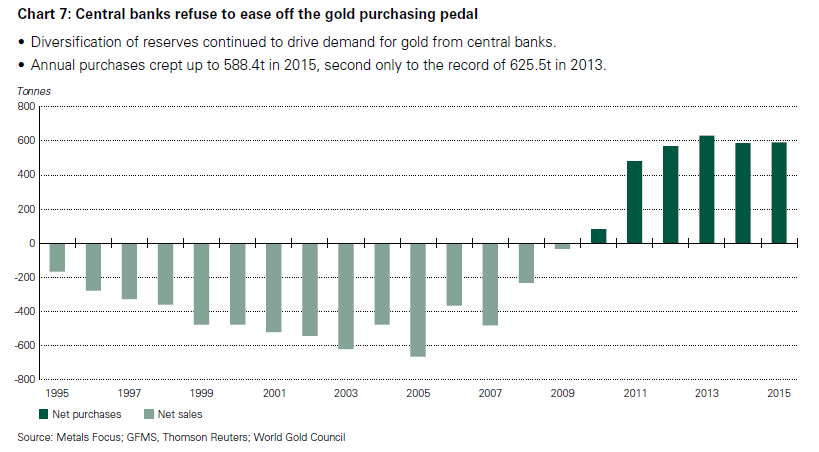

Central bank purchases also helped drive the 47 ton increase in global demand in Q4 2015. Central bank buying increased 33 tons compared to the fourth quarter of 2014:

Central banks net purchases ended the year strongly at 167.2 tons in Q4, up 25% from 133.9 tons in the same period of 2014. This brought net purchases for 2015 to an impressive 588.4 tons, 1% higher than 2014’s chunky total of 583.9 tons. The annual total was significantly higher than our initial expected range of 400-500 tons…This shows that the pivotal change in 2010 – from net sellers to net purchases – has staying power.”

As overall demand for gold surged during the last half of the year, supplies shrank. Annual mine production last year increased by the slowest rate since 2008 and recycling fell to multi-year lows. Total supply declined 4% to 4,258 tons. That’s the lowest level since 2009, according to the WGC.

Gold demand defied the headwinds and rallied during the last half of 2015. With plenty of clouds on the economic horizon, it seems likely demand will remain robust as we continue through 2016.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

The central banks can see the end of the era of junk fiat currencies.Most currencies have fallen against the almighty Dollar.When the Dollar goes,the game ends.They know that gold is money and fiat currencies aren’t.Follow their lead,to save yourself.