Foreign Share of US Debt Plunging; Fed Picking Up the Slack

Over the last year, the US government had borrowed over $4.2 trillion. The national debt now stands well above $27 trillion. There is no end in sight to the borrowing and spending and that raises a significant question: who is going to buy all of the bonds necessary to finance the government spending machine?

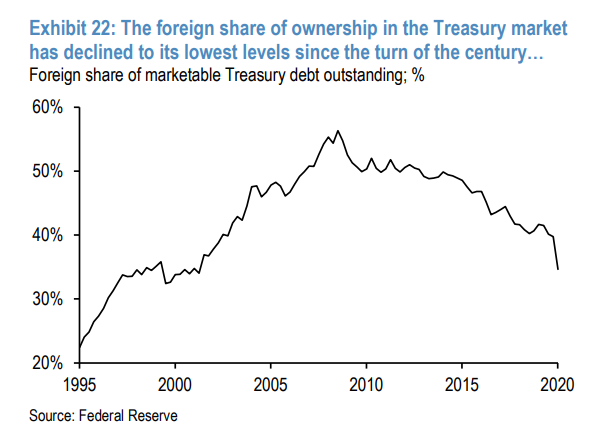

Not too long ago, Uncle Sam could count on foreign investors to gobble up a big chunk of his IOUs, but times are changing. In 2008, foreign investors held more than half of the outstanding Treasury debt. Today, that amount has plunged to the lowest level since the turn of the century.

China and Japan have been the biggest foreign buyers of US debt in recent years. Japan ranks as the largest foreign creditor. The Japanese have continued to buy Treasuries over the last year but at a much slower pace. The country increased its holdings by just $15 billion in Q3. Over the last year, Japan has increased its US debt holdings by $130 billion.

Meanwhile, China is dumping Treasuries. It sold off about $13 billion in US Treasuries in Q3 and has shrunk its holdings by $40 billion over the last year.

Over the past five years, Japan’s and China’s combined holdings of US Treasuries have remains relatively stable. At the end of September, the two countries combined held about $2.34 trillion in US bonds, down slightly from the $2.37 trillion they held at the end of 2015. But Japan and China’s combined share of the rapidly skyrocketing US debt now amounts to just 8.7%, down from about 13% in 2015.

This is significant because as the US continues to increase the pace of its borrowing and spending, two of America’s biggest creditors appear less and less interested in financing this giant pile of debt. Borrowing is going up and up but foreign lending isn’t keeping pace.

So who is going to buy all of the debt that’s still coming down the pike?

It looks like the responsibility will increasingly fall on the Federal Reserve. In fact, the Fed is already backstopping the market and making this borrowing binge possible.

In Q3, the Fed bought $240 billion in US Treasuries. That brought its total Treasury holdings to $4.44 trillion. The central bank now holds a record 16.5% of the US debt load.

In the last 12 months, the Fed has doubled its holdings of Treasuries, adding a staggering $2.4 trillion in US government bonds to its balance sheet – most of that since March. The Fed’s total share of US debt has spiked from 9.3% in Q1 to 16.5%.

Without the Fed’s intervention in the bond market, it would be virtually impossible for the US government to borrow money at the current level. As we’ve seen, foreign demand is already waning, even with prices artificially inflated. Interest rates would have to soar in order to entice average investors to buy US Treasuries. The market would collapse.

The Fed is financing all of this bond-buying with money created out of thin air.

As we have said before, the Federal Reserve had no exit strategy from its extraordinary monetary policy in 2008 and it certainly has no exit strategy today.

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […] The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.

The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.