Foreign Central Banks Yanking Gold Out Of Fed’s Vaults

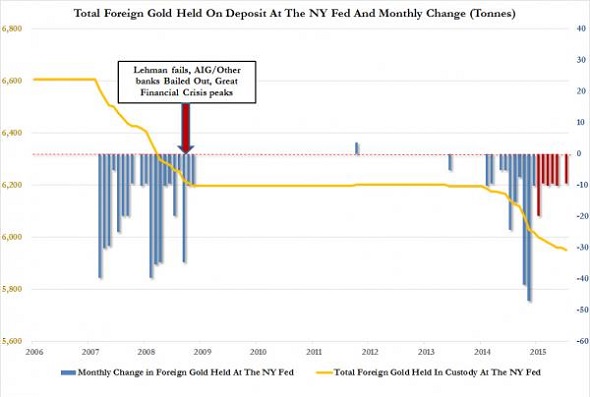

Foreign central banks want their gold back and they are pulling it out of Federal Reserve bank vaults.

According to a recent Federal Reserve report on its foreign official assets, physical gold holdings fell 9.6 tons last month to 5,950 tons. Total foreign physical gold held by the Fed now sits at just over $8 billion, down more than $67 million since January. If that figure sounds low to you, it is. Since 1973, the Fed has valued its gold based upon a statutory $42.22 price per ounce.

Federal Reserve foreign gold holdings dropped every month this year except June, when they held steady. Put in broader perspective, foreign central banks have withdrawn 192 tons of gold over the past year, and 246 tons since the January 2014.

This reflects a continuing trend of foreign gold repatriation.

In early 2013, the German central bank (Bundesbank) announced it would begin the process of repatriating massive amounts of its physical gold reserves back into the country. The Bundesbank repatriated 120 metric tons of gold in 2014. In the fall of that same year, the Netherlands followed suit, taking delivery of some of its physical gold holdings from the New York Federal Reserve Bank. The Dutch central bank increased its domestic holdings of physical bullion from 11% of total gold reserves to 31%.

Last May, Austria became the most recent country to announce plans to repatriate gold. According to the Guardian, the Austrian National Bank plans to bring home to 80% of its entire gold stock – “after auditors warned against the risks of keeping a majority in a foreign country.” The bank will fly gold bars back to Vienna over the next five years, raising its in-country stocks to 140 tons.

Even the state of Texas wants to bring its gold home. A bill signed by Gov. Greg Abbott in June creates a state gold depository and sets the stage to repatriate $1 billion of gold back into the state.

In the midst of uncertain currency wars, countries want to bring this essential reserve asset back home in case of financial emergencies. Some analysts also see it as a sign of distrust of the Fed, and an indication that the Federal Reserve may not hold as much bullion as it claims. The continued exodus of gold from the Fed’s vaults seems to support this analysis.

As Matthew Lynn wrote for MarketWatch last December, fear of a massive currency crisis is the primary reason so many countries would want their gold back on sovereign soil.

The point about having gold on your own soil is that it is an insurance policy against a chaotic return to national currencies. The fact that so many countries seem to want that insurance tells you something important about the euro — and it is hardly comforting. They still think there is a real possibility of collapse…There are not many circumstances in which holding a big stash of gold on your own territory matters very much. But one of them is the sudden, chaotic reorganization of your currency. If a country were to introduce a new currency overnight then if it could be backed by some gold right from the start that would give it some instant credibility in the markets. Repatriating gold only makes sense as a way of preparing for that to happen.”

Holding gold in case of financial crisis not only makes sense for central banks, but also for individuals. Gold historically preserves wealth and provides financial security in times of economic chaos. Peter Schiff’s Why Buy Gold Now? report provides in-depth analysis on the US economy and the gold market.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Have been setting aside some funds to begin investing in precious metals. Not sure where exactly to start. Of/ms70 newer stuff, or just start buying billion as close to spot as possible?

Hi David. SchiffGold recommends the latter – high-quality, liquid bullion as close to spot as possible. Please feel free to give one of our Precious Metals Specialists a call – they are more than happy to help you understand your options without pressuring you to buy. 1-888-465-3160.