Fed Up Friday: Sept. 3 – Sept. 9

It seems like a long time has passed since all the hawkish talk from the Fed after the jobs report came out. That’s probably because this week has seen mounting evidence that a rate hike before December, or possibly even 2017, is now highly unlikely. Learn more about it in this week’s Fed Up Friday.

3 Reasons Fed Rate Hike Might Not Even Hit in December

Ever since the Jackson Hole symposium, a Fed rate hike in September has supposedly become more possible. But this week has brought a halt to all the speculation and a reversal of sentiment. In two short weeks, things have taken a swift 180 with chances of a 2016 decline seeming even dimmer. Michael Farr, President of Farr, Miller & Washington, can list three reasons why the next hike will be pushed to 2017:

- Considerable drops in job growth, wage growth and length of work week data. Some as low as 2010 numbers.

- Recent escalation of 3-month LIBOR, the rate at which banks lend to one another, is evidence of tightening financial conditions.

- The election draws closer, and likely economic fluctuation based on the results could make the Fed think twice about any economic tweaking for several months.

European Central Bank isn’t Afraid to Admit: Bad Time for Rate Hikes

Thursday’s European Central Bank (ECB) meeting was adjourned without a rate hike to everyone’s expectation. Unlike the Fed, who seems to enjoy obfuscation, the ECB is fairly transparent about their reasons behind maintaining low rates. It’s now clear they intended to keep rates at their current levels or even lower for an “extended period.”

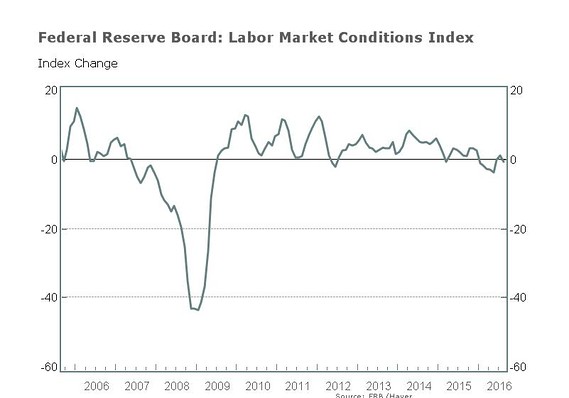

Fed Labor Market Indicator Slips, Mimics 2008 Trajectory

The Fed’s indicator combines 19 labor market figures to create one all-encompassing chart, and things aren’t looking good. Designed to give a broader peek into the momentum of the jobs market, it has been negative 7 out of the past 8 months. Overall this year the chart has been at its lowest points since 2008, and the current trajectory is following eerily close to how things looked in that recession’s beginning phases. The sharp drop and slight recovery before a massive decline is quite similar:

Even if Fed Hikes Rates Soon, They Could Stay Low for Years

Private equity monolith KKR believes that the Fed is in a long-term dovish cycle that won’t ease up until we get into the 2020s. KKR’s head of global macro and asset allocation Henry H. McVey isn’t talking about a quarter-point rate hike, but he does expect the rate to stay below 1% for the long term.

In reference to Janet Yellen’s talks about a “neutral” funds rate, McVey said, “Not surprisingly, given all these types of remarks as well as sluggish growth, the fed funds rate is now below 1 percent and we think it … could trend below 1% until at least 2020.”

ISM Non-Manufacturing Index at 6-Year Low

The Institute of Supply Management (ISM) released it latest Non-Manufacturing Index number on Tuesday. The composite index, which monitors employment, production, inventories, new orders and supplier deliveries, fell from 55.5 in July to 51.4 in August, the lowest since February 2010. Growth in the index usually indicates strong corporate profits. However, the recent drop is yet another indicator of a weak US economy.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]