Fed Up Friday: August 20-26

The Fed’s been looking for new friends this week, tuning out the haters and struggling to convince the public about potential rate hikes. Check out their follies below!

Flip-Flopping Fed Gets No Credibility from Market

A market that doesn’t care about the direction the Fed wants to take us can be a recipe for a firestorm. In 2016, the market’s faith in the Fed seems to be at an all-time low as they tout guidance, yet change course with as little as a single economic report contradicting them. All eyes were on Jackson Hole today as Fed Chair Janet Yellen opened up the annual Economic Symposium.

So what did she say? She stuck to her guns about the (now laughable) potential for another rate hike before the election. Those guns include being as vague as possible and hinting that a rate hike may or may not be coming very soon. All in all, Yellen didn’t really say much at all, other than to continue her standard issue talking points and give very little guidance for the market on the direction of the US economy.

According to Charles Schwab’s chief fixed income strategist, Kathy Jones: “Yellen succeeded in leaving the door open to almost anything. Unless there’s a huge rise in jobs in the next jobs report, [a rate hike is] still probably more likely in December than September.”

Fed Searches for Facebook Friends, Attracts Its Enemies

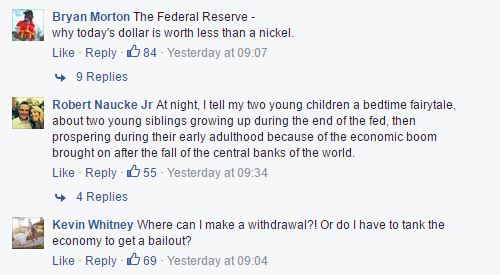

The Board of Governors of the Federal Reserve System made a bold move recently to create their very first Facebook page – a move that sent many, many unhappy people flooding their comment section telling the central bank how they really feel. If you take a look through their posts, you will be hard-pressed to find a single positive comment. Here’s just a small sampling:

Not that we would encourage negativity, but if you feel the urge to tell the Fed how you feel about their handling of our economy, there is now a great public forum to reach out and talk to them.

Massive Bond Portfolio Needs to Shrink at the Fed

In the wake of the 2008 financial collapse, the Fed took to buying Treasuries in an effort to stifle the downturn. Since then they’ve acquired 4.5 trillion in debt. This has caused many analysts to question whether the Fed’s approach to resolving the economy are valid, as holding on to these assets for so long indicates short term methods are still being used to try and solve this long term condition.

David Berson, chief economist for Nationwide Insurance, said, “So you get higher rates and less liquidity in the economy overall but at the same time you get a steeper yield curve and for financial institutions, you would improve the net interest margin, which is positive.” Interest rates have been too low for too long, and these analysts suggest “negative quantitative easing” to allow the debt to run off.

Wall Street Isn’t Convinced Fed Has Policy Plan at All

This year has given those trying to predict the Fed’s next move plenty of pause. It often feels as if they’re blindly reaching out trying to find the “solve economic problems” button. In a recent CNBC Fed Survey, it appears that most of the country doesn’t think the Fed has any framework for deciding on interest rates either.

In the article, Peter Boockvar of The Lindsey Group expressed his frustration, saying, “We’ve been led in so many different directions only to be spun around again, that until I see exactly what they do, I’m losing patience in listening to what they say.”

We’re a little fed up too, Mr. Boockvar.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]