Fed Up Friday: August 12 – 19

The US Federal Reserve Presidents have been busy this week, flexing their speculative muscles and antagonizing the markets. In case you missed it, here’s everything they’ve been up to in the past seven days.

Global Banks Abandon US Bonds: Largest Selloff since 1978

In total, $192 billion of US Treasury bonds have been dumped off by other nations’ central banks in the first half of 2016, according to CNN Money. That’s more than double the rate of 2015. What does this mean? The world economy seems to be showing an overall trend of drastic weakening. Many of the nations, which include China, Japan, France, and others, need quick cash in an attempt to stabilize their shaky economies.

Earlier this year, chief of the International Monetary Fund Christine Lagarde predicted the beginnings of a global economic destabilization.

“There has been a loss of growth momentum,” Lagarde said. “Emerging markets had largely driven the recovery and the expectation was that the advanced economies would pick up the ‘growth baton.’ This has not happened.”

Now that these numbers have been released, it seems world banks are retreating inwards more quickly than the IMF anticipated. That’s a move Lagarde sees as a danger to everyone.

The Fed Cries Wolf Once Again, Still No Wolf

Peter Schiff raked a couple Fed Presidents over the coals in a recent episode of “The Peter Schiff Show”. New York Federal Reserve President William Dudley was making off-the-cuff remarks during an interview about a September rate hike being “possible.” Of course, the market overreacted as usual to the mention of the possibility of any move. Peter compares a September hike to be as likely as extraterrestrial visitors.

A September alien invasion is still possible, but I’m not going to waste my time preparing for it. What’s amazing to me is how all of the villagers still come running every time a Fed official cries ‘Wolf!’ Haven’t they noticed that they’ve cried, ‘Wolf!’ over and over again and there’s never a wolf?”

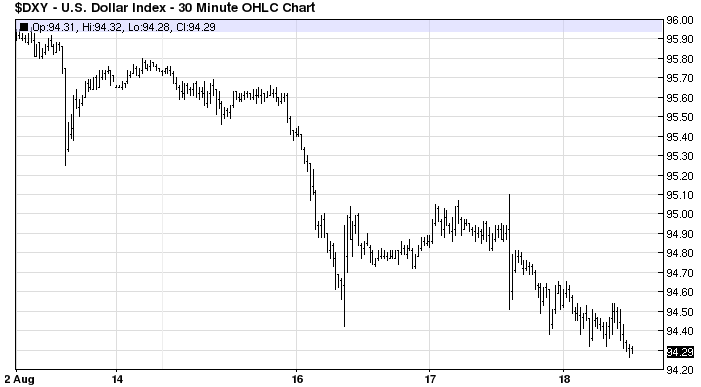

Dollar Crashing as Investors React to Fed President’s Remarks

As the Fed Presidents were busy disrupting markets with their own speculation, investors began to challenge their ideas. The dollar index began its descent after Fed President William Dudley said September rate hikes were possible.

On Wednesday, BK Asset Management’s head of foreign exchange strategy, Boris Schlossberg, said of Ludley’s comment, “Certainly the market thinks it’s kind of absurd. I mean, the biggest dichotomy in the market right now is what the Fed is saying and what the market is doing.”

Fed’s Method Ineffective, Monetary Policy is a “Dead Duck”

Much of the Fed minutes from their meeting last month discussed monetary policy, which is being panned by critics as a “dead duck”. Critics say the policy has widened wealth inequality for the sake of bailing out the economy. The Fed has been slowly unwinding their QE and negative interest rates but has had little luck in raising rates without backlash.

Marino Valensise, head of multi-asset and income at Baring Asset Management, had this to say about world central banks and their views on monetary policy:

They know it’s not effective, but no one is going to tell us. They are never going to admit it. There are certain things central bankers cannot tell, there are certain things that central bankers cannot do.”

Valensise senses that globally, investors are watching the Fed closely to look for cues about future plans. At the same time, the Fed is monitoring the global markets for clues about how it might handle a change. This back and forth will most likely result in a market deadlock for the foreseeable future until one of the groups make a move.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […] The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.

The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.