Failing Welfare States: Greek Taxes & US Social Security

Banks in Greece reopened on Monday, and even with strict withdrawal limits in effect, it at least gave the appearance of a return to normalcy. But Greeks also woke up Monday to a painful new reality that should serve as a warning to Americans.

Massive tax hikes went into effect, part of the austerity measures demanded by creditors in the latest bailout deal. As the AP reported, the increased taxes are another blow to Greeks already battered by years of economic crisis.

There are few parts of the Greek economy left untouched by the steep increase in the sales tax from 13 to 23 percent. The new rates have been imposed on basic goods, from cooking oil to condoms, as well as to popular services, such as taxi rides, eating out at restaurants and ferry transport to the Greek islands.

“The tax hikes are part of a package of austerity measures that also include pension cuts and other reforms that the Greek government had to introduce for negotiations to begin on a crucial third bailout.”

Of course, this was inevitable. The Greek people demanded and got a generous welfare state. Now they must pay the piper.

America, take notice.

At some point, somebody always has to pay. It’s a simple matter of mathematics. You can’t indefinitely spend more money than you make. Debasing the currency and foreign bailouts only go so far. The Greeks are learning the hard way that when the bill ultimately comes due, somebody has to step up to the register and pay the check.

Greece backed itself into a tight corner with unrestrained spending and generous benefits. As the Guardian recently reported, “pensions are now the main – and often only – source of income for just under 49% of Greek families, compared to 36% who rely mainly on salaries.” Those workers earning salaries ultimately have to support not only themselves, but also the masses drawing off the indebted system. The burden placed on the Greek economy by this unsustainable pension system contributed mightily to the country’s financial woes. Throw in a welfare state that discourages work, and you have a recipe for the economic meltdown.

This should serve as a blaring warning siren for America as she continues to hurtle down the exact same path.

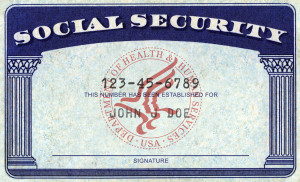

Last week, we showed you the parallels between the Greek pension system and many state retirement systems in America. Wednesday brought more troubling signs that bode ill for long-term economic stability in the US, with the release of the government’s annual Social Security report. As the AP reported, some 11 million Americans who depend on Social Security disability face steep benefit cuts next year.

The trustees who oversee Social Security and Medicare said the disability trust fund will run out of money in late 2016. That would trigger an automatic 19 percent cut in benefits, unless Congress acts.

“Separately, about 7 million Medicare beneficiaries could face a monthly premium increase of at least $54 for outpatient coverage. That works out to an increase of more than 50 percent.”

Benefit cuts and price increases – just like Greece.

Of course, Congress will likely figure out a way to continue kicking the can down the road. After some political posturing, lawmakers will avert the crisis – for the time being. But in the long-term, the entire Social Security Ponzi scheme is destined to collapse. According to government figures, the system will run completely out of money in 2034.

Hopefully you’re not counting on Social Security to fund your retirement.

The United States commands a lot more resources than Greece. The government might be able to put off the inevitable consequences of its deficit spending for a while. But the US doesn’t get a free pass when it comes to unsustainable policies, and there is no get out of jail free card. Just like Greece, Americans will ultimately have to pay the price for its free-spending policies.

If the US continues down this path, it really isn’t a matter of if a Greek-style crisis will hit. It’s just a matter of when.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Everything Peter has warned about has made sense to me. I have moved the correct portion of my savings out of the reach of anyone but myself. This has been a slow motion wreck, allowing anyone the chance to avoid the obvious dollar crash that is coming. In addition I don’t like Ira gold accounts. Why tell a drunk where your gold is?