Economic Realities Driving Mexicans Home

Mexican immigrants are going home.

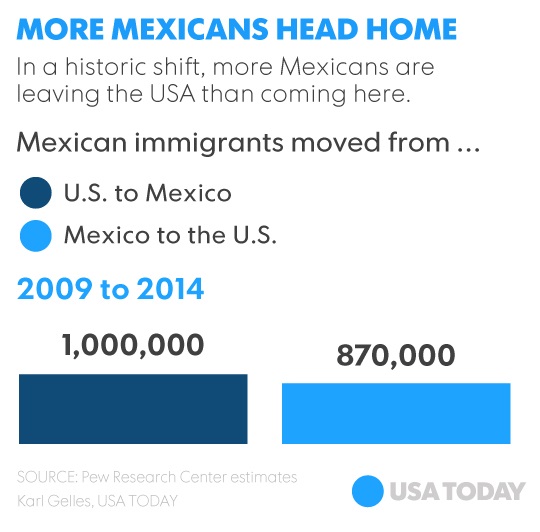

For the first time in more than 40 years, more Mexicans are leaving the United States than entering. Citing a Pew Research Center report, USA Today notes that from 2009 to 2014, an estimated 870,000 Mexicans came to the US, while 1 million returned home. That represents a net loss for the US of 130,000.

Pew director of Hispanic research Mark Hugo Lopez cited a number of reasons for the immigration shift:

The net decline in Mexicans was driven by the Great Recession in the United States that made it harder to find jobs, an improving economy in Mexico and tighter border security.”

The vast majority of Mexicans returning home do so voluntarily, according to the report:

Only 14% of the 1 million Mexicans who returned to their country since 2009 said they did so because they were deported. A majority said they returned of their own accord, with 61% saying they did so to reunite with family.

So clearly enforcement isn’t the cause of the exodus. The first two factors Lopez mentions seem to hit on the primary impulse driving Mexicans home. They are the same dynamics that tend to ultimately drive all immigration patterns – economics.

In relative terms, job prospects in Mexico continue to improve. The US employment market remains fundamentally stagnant, despite the impression created by the rosy numbers reported by the government.

Many Mexicans also find the lure of more American dollars offset by the cost of living and high taxes in the states.

Eduardo Sanchez came to the US in 2006 and started a successful contracting business in Kentucky. He plans to return to Mexico within the next two years. His brother left the US last month. He said he believes he can ultimately be more successful at home, free from the regulatory and tax burdens he endures in the states.

It’s true you come to America, you make more money. But you also spend more. I must pay for licenses and lots of high tax here. At home, it’s not so bad. There is much work in Mexico now. Lots of building – construction. I go home and make work, and employ people there.”

In fact, it’s not just Mexicans leaving the states to escape the tax burden. In 2014, a record 3,145 Americans renounced their citizenship or residency. According to the Treasury Department, that represented a 14% increase over 2013 – also a record year.

Peter Schiff noted the number of people willing to jump through significant hoops required to give up their citizenship continues to rise despite increasing exit fees:

The reason is taxes. America has the world’s most oppressive tax regime, and the cost of staying compliant is going up. Many Americans living abroad find their US citizenship to be a liability rather than an asset, and they’re willing to spend a lot of money to renounce that citizenship. In fact, up until 2010, the form that you needed to fill out to give up your citizenship was free. In 2010 they imposed a fee of $450, which made the US the most expensive nation with which to renounce your citizenship. Yet people had no problem paying it. Last year, they increased the cost of that form to $2,350. Again, record numbers of people were willing to pay that just for the privilege of renouncing their citizenship.

It appears the US government will soon make the tax burden even more burdensome.

The US may soon have the power to revoke American passports if the IRS says they owe more than $50,000 in delinquent taxes.

In a letter to Congress obtained by MarketWatch, Marylouise Serrano of the group American Citizens Abroad expressed concern that the expatriate community would bear the brunt of this policy.

Enactment of this legislation would come at a time when the Internal Revenue Service’s, including Collections’, ability to render services to taxpayers overseas, and, in effect, help them ‘work out’ their collection problems, are severely reduced.”

An HSBC survey of global expatriates reveals almost all of the top reasons offered for giving up citizenship revolve around economics, including improving job prospects, boosting earning potential, and improving their overall quality of life.

Perhaps we would be wise to look at the behavior of real people rather than government numbers as we consider future economic prospects in the US. The number of Mexicans returning home and Americans willing to renounce citizenship seems to indicate maybe future economic prospects in America aren’t all they are cracked up to be.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Something about Mexicans heading to Mexico sounds very fishy. It’s just what the Feds would like people to think.