Debt Is an Elephant in the Room and It’s Going to Rampage

Debt is crushing the American economy.

Over the last month or so, the mainstream seems to have realized that the economy isn’t on nearly as solid ground as government officials and central planners were telling them throughout 2015, and all of a sudden, gold is in vogue. But as we pointed out last week, the signs of economic distress have been there all along.

One underlying fundamental that seems to get swept under the carpet is the staggering level of debt – both public and private.

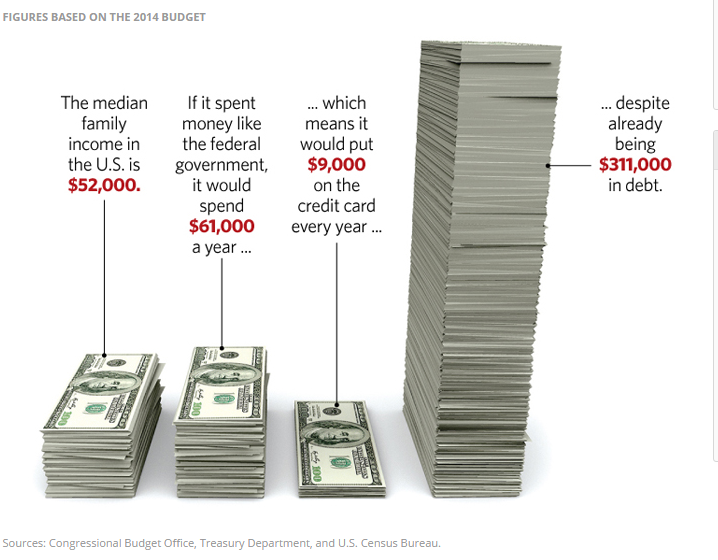

Last week, the US national debt crossed the $19 trillion threshold. Most of us can’t even grasp that number. The graphic above created by the Heritage Foundation puts it into vivid perspective, illustrating what this level of indebtedness and spending would mean to the average American household.

It’s easy to see just how much trouble a family is in when it’s $311,000 in debt and still putting $9,000 more a year on credit cards. Yet, when it comes to the federal government, everybody acts like it’s no big deal.

It really is.

Just consider the US budget ramifications pointed out by Yonathan Amselem in a column on the Mises Institute website:

Low interest rates stemming from a growing money supply are the only reason the US government has managed to service its gargantuan debt in recent years. The Congressional Budget Office itself has pointed out that even a slight rise in interest rates could potentially result in anywhere from $700 to $900 billion in annual tax payments just to service the interest on our debt. At this pace, paying the republic’s creditors will become our largest government program in no time. Future Americans might go to work and have 50% of their paychecks seized not to pay for government services, but simply to service debt forced on them by central planners.”

This is just one of many reasons the Federal Reserve cannot embark on a sustained program of interest rate hikes.

In his recent Gold Videocast, Peter pointed out how the Federal Reserve and government central planners have built a house of cards on a foundation of debt and at some point, it will all come crashing down.

The national debt just surpassed $19 trillion officially. It’s going to be $20 trillion by the time Barack Obama leaves office, maybe more. He’s doubled the national debt. The next president is going to have to double it again in order to keep this house of cards from collapsing. I think it’s impossible to finance that type of growth in debt. But that’s what this bubble economy needs because all of our GDP grows based on debt. It’s not real economic growth; it’s just consumption that’s borrowed. And you need to borrow more and more money to get less and less GDP growth, and we’ve run to the point where we can’t do it anymore. The world is not going to continue to give us a pass, and so gold prices, I think, are going to take off.”

Artificially low interest rates have enabled the government to borrow, spend, and increase the debt. Central bankers have distorted the economy with easy money, and as Amselem pointed out, it’s not just government that has run up a huge bill as a result:

Public debt is far from the only distortion artificially low rates have wrought. Mortgages, auto loans, credit cards, and student loans have ballooned total consumer debt to $12 trillion, and this number is only trending upward. The easy credit economy manufactured by central bankers has obliterated American savings and replaced them with debt. The average American consumer has less than $1,000 in his bank account. He lives praying for no car trouble or a broken arm.”

And then there is corporate debt:

Since 2008, corporate debt has doubled. Almost 100% of all corporate issued debt has been used to buy back stocks and prop up equity prices. This bears repeating. Almost none of America’s recently issued corporate debt has gone toward investing in plant and equipment, increasing the workforce, research and development, or expanding operations in any meaningful way.”

The extreme debt load in America today is one of those underlying fundamentals that simply can’t be ignored. Since years of Federal Reserve low interest rate policy helped build and sustain the US debt economy we have today, it’s now impossible for the Fed to take away the drug. The junkie would go into withdraw and things would quickly spiral out of control. Just consider the aftermath of the small December rate hike. This is why Peter can so confidently say the Fed won’t keep raising rates. It is more likely to drop them back to zero, or even into negative territory, and then launch into another round of quantitative easing.

Debt – personal, corporate, and national – is a huge elephant in the room. At some point, it is going to go on a rampage.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Where can one hide in the United States?

With all the gold in the world, one needs ‘law and order’ plus groceries and all the intra-structure that functions now to exist.

Go to Canada, Switzerland, or Singapore?

Sid Rose

I believe that people over 60 with various form(s) of savings understand this. Some younger folks too. I know for a fact that financial advisors are staying with stocks and bonds while offering the idea that there will be plenty of time to jump out of stocks, dividends etc. and into safer havens if or when the economic issues start to look “iffy”. “Iffy” as such, has been the undefined variable. China, Europe, oil, terrorism, water shortages, debt servicing, environmental impacts & change?? There are so many ominous “iffy” dark clouds hanging over the world already, any one of which could deliver the overnight Eco-storm of the century. The “my book” talk of the big banks and hedge fund managers is luring people away from the underlying economics which should otherwise be obvious to everyone, but aren’t. The influence peddlers are lining their pockets at everyone else’s expense. Shame on 99% of the world for allowing this to happen. It’ll be too late when the first distant boom of thunder sounds an alarm, even in the tech-savvy, instant tele-notification world. I’m not selling my precious metals until the dust settles, if ever. Wanting to buy won’t be enough to get the rest of us to sell.

I wish they would quote these stats on individuals, not families. Median family income? How many people in the U.S. does that exclude?

They should have said ‘household income’ not family income.

‘Median’ means ‘the middle’. That means line up all your incomes from richest to poorest and pick the middle value.

That 1 individual income – smack in the middle.

So to answer your question, ‘the median’ excludes all of the richest…and also all of the poorest, basically all the population, except one, the one in the middle, the ‘median value’ income.

Of course when you look to the numbers/people to the left or right of that one median value there will be more than one earning that exact income.