Day 21: Trump Begins Looking Into Financial Regulation Reform

Trump’s third week in office brings us a look into rolling back financial regulation reforms, the power of the @POTUS’s tweets, and the new Department of Education director.

New Executive Order Likely to Target Dodd-Frank

This week, Trump signed an executive order calling for a review of financial regulations. Many Democrats are concerned the audit will target the Dodd-Frank regulations enacted to protect consumers after the 2008 meltdown. Although Trump’s request didn’t specifically mention the regulatory law, he has expressed his frustration with it in the past.

Trump has stated he’s witnessed the negative effects of Dodd-Frank firsthand: “I have so many people, friends of mine that had nice businesses, they can’t borrow money. They just can’t get any money because the banks just won’t let them borrow it because of the rules and regulations in Dodd-Frank.”

Many Democrats have expressed concern that Trump’s administration will target aspects of Dodd-Frank like repealing the Volcker Rule, which limits certain types of riskier investments by banks using their own funds. Another potential target is the fiduciary rule, which ensures financial advisors work in the best interest of their clients as opposed to their own financial gain.

Repeal of regulations set up to protect investors could face opposition from Republicans who continue to fight with Democrats over winning middle-class voters.

There’s Power in the Tweet

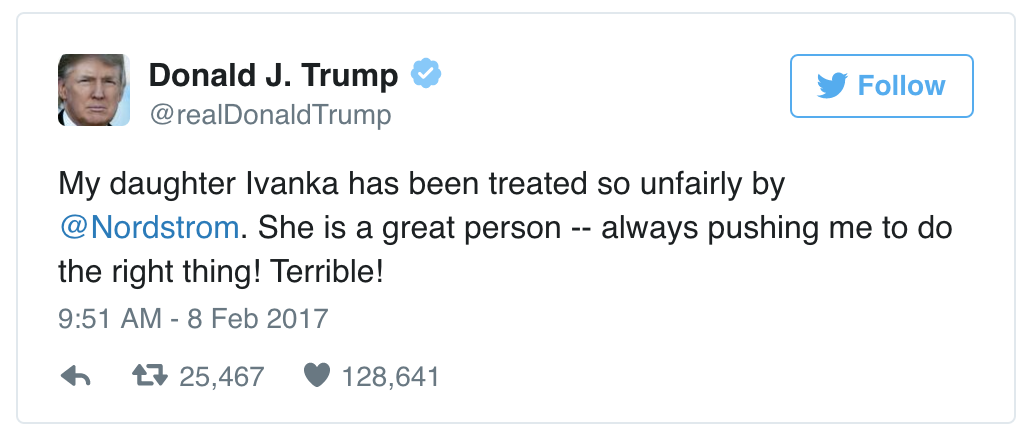

Trump’s tweet-a-thon continues to create controversy and conflicts of interests for the socially loquacious Commander-in-Chief. The latest controversial tweet involved the President’s daughter, Ivanka, after Nordstrom department stores announced it was dropping her clothing line. In the tweet, Trump pushed back at the company claiming it had treated his daughter “unfairly”. The official @POTUS account then retweeted Trump’s personal tweet.

Within moments of his tweet, Nordstrom’s stock took a sharp downward turn only to recover shortly afterward. At one point, the price was “down 0.3% at about $42.65 at 10:50 a.m., then was down as much as 1% at $42.36 within a minute of Trump’s tweet,” according to MarketWatch. The event wasn’t unprecedented. Back in December, a Trump tweet announcing he wanted to cancel Boeing’s contract for replacing future Air Force One jets sent the military contractor’s stock down 1%.

The impact to the economy and individual companies has many concerned with how Trump will further affect specific businesses that meet his disfavor.

Betsy DeVos Confirmed as Secretary of Education

This week lawmakers confirmed controversial pick, Betsy DeVos, as head of the Department of Education. DeVos’ confirmation hearing seemed to highlight her inexperience with some important information about the US educational system like the Americans with Disabilities Act (ADA). Nevertheless, her successful confirmation suggests she may have a big impact on the trillion-dollar student loan program, according to MarketWatch.

DeVos misquoted the amount of student loan growth, stating it had grown over 980% over the last eight years. The accurate figure is closer to a 100% increase. Her inexperience with the educational system is leaving some questioning whether DeVos will be unduly influenced by special interest groups representing for-profit education.

The Education Department head is also responsible for overseeing a program instituted by Obama to prevent for-profit colleges from misleading students with overstated results of their education. DeVos has said she would review those regulations to ensure fairness for both parties. Some are questioning whether DeVos can remain impartial with the matter given Trump’s own financial interests with his for-profit Trump University.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]