As Bond Yields Plunge, More Mainstream Investors Jump on Gold Bandwagon

Over the last few months, a number of big-name, mainstream investors have said buy gold. Stanley Druckenmiller publicly advised investors to sell US stocks and buy gold. Legendary hedge fund manager Paul Singer said “it makes sense to own gold.”

With Brexit now a reality, and bond yields slipping lower and lower, the gold bulls continue to charge. This week, Joe Foster, gold strategist at VanEck, jumped on the bandwagon, saying he expects $1,400 gold this year, and he doesn’t believe it will end there:

Many are seeing the looming potential for another financial crisis and making a strategic allocation to bullion as a hedge against systemic risk.”

TD Securities also predicts $1,400 gold and said $1,500 is possible if the Federal Reserve further cools market expectations for an interest rate hike:

Given that there are likely to be significant flows into gold and other precious metals seeking protection from the current turmoil, the record amount of net-long exposure should not impede the yellow metal from trending toward $1,400 per ounce. If we see the Fed downgrade its rate forecast in the not-too-distant future, a move toward $1,500 per ounce is also very possible, particularly if the negative yield narrative grows even louder.”

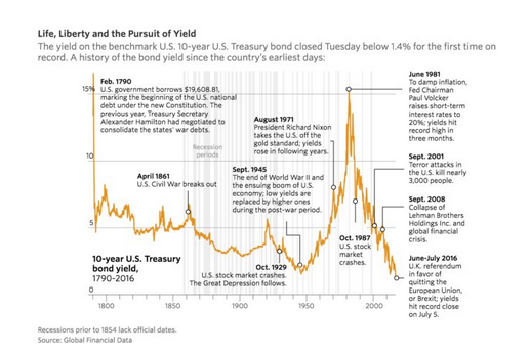

Meanwhile, on Tuesday the yield on a 10-year US Treasury hit the lowest level since 1790, falling below 1.4% for the first time on record.

Many bonds around the world are yielding less than zero. MarketWatch recently reported analysis by Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch, showing the utter ineffectiveness of years of central bank interest rate cuts and quantitative easing. He found that central banks around the world have cut interest rates a combined 659 times since the Lehman Brothers bankruptcy:

He estimated that $12.9 trillion worth of bonds were yielding less than zero, equivalent to 29% of total bonds outstanding. The three-year Swiss government debt currently holds the title of yielding the least at minus 1.1%. Treasuries so far have escaped the fate of their European and Japanese peers but US yields remain under pressure as the Federal Reserve is expected to refrain from hiking interest rates immediately because of global economic and presidential election uncertainties.”

Follow the latest economic developments and their impact on gold. Subscribe to Peter Schiff’s Gold Videocast

Central banks have already made moves toward further easing and rate cuts in the wake of Brexit. It seems almost a certainty the negative yield narrative will get louder.

VanEck’s gold strategist echoed these thoughts in a Kitco News report:

Foster sees several factors in the global economy that will continue to support gold prices in the long term, including continued loosed monetary policy and low bond yields. Quoting the latest report from ratings agency Fitch, he noted that $11 trillion in sovereign debt is offering negative yields. ‘Bonds no longer provide safe and steady returns. Investors may seek alternatives to help preserve their wealth,’ he said. Foster also said that weak global growth and volatile currency markets will make gold an attractive investment.”

Peter Schiff has maintained the Federal Reserve will soon cut rates and launch a new round of quantitative easing. He reiterated that point in an interview with Alex Jones on InfoWars:

They have nothing left. I think all they’re going to do now is try to change their rhetoric and try to talk about not raising rates, then they’ll talking about cutting rates, then they’ll eventually cut them, and then they’ll take them negative. But I think also somewhere along the way they’re going to restart their QE campaign. I think QE4 is going to be bigger than one, two, and three combined, and it’s going to be even more destructive to the standard of living of average Americans.”

Peter has been pounding this narrative for months, and now the mainstream is starting to see the writing on the wall as well. Central banks aren’t going to suddenly change their ways. That bodes well for gold.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

“Insanity is doing the same thing over and over again, but expecting different results” is a quote that has been attributed to Einstein but there is conjecture over the origin. In regards to the Fed and QE, there has never been a quote so suitable.