2020 Budget Deficit Comes In at a Cool $3.13 Trillion

The fiscal 2020 budget shortfall totaled $3.13 trillion as Uncle Sam added another $124.6 billion to the deficit in September, according to the latest Monthly Treasury Statement.

That more than doubles the previous record deficit of $1.4 trillion set in 2009 at the height of the Great Recession.

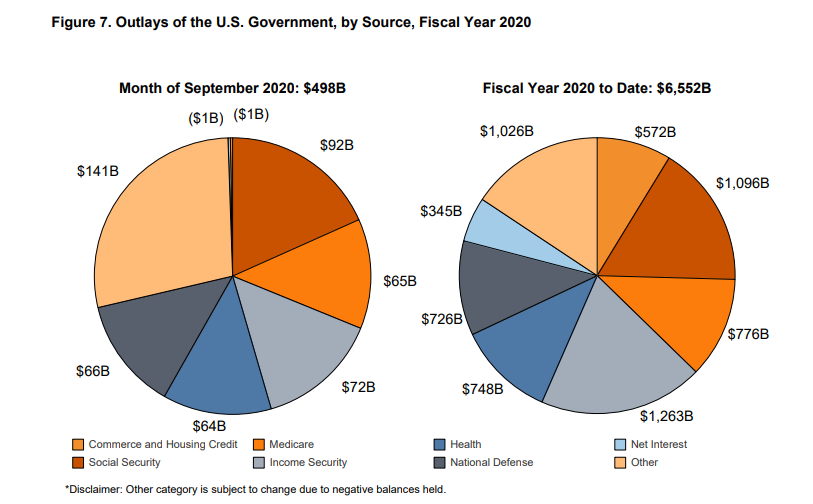

The fiscal year ended on Sept. 30. Revenues were basically flat on the year, falling slightly from $3.46 trillion in FY2019 to $3.42 trillion. But total spending soared, coming in at $6.55 trillion. That compares with $4.45 trillion spent in fiscal 2019.

The national debt surged above $27 trillion on Oct. 1, and it has grown by over $7 trillion since President Trump took office. That equals $217,612 of debt for every American taxpayer.

When Trump moved into the White House in January 2017, the debt stood at $19.95 trillion. It topped $22 trillion in February 2019. That represented a $2.06 trillion increase in the debt in just over two years. By November 2019, the debt had eclipsed $23 trillion.

The debt-to-GDP ratio currently stands at 137.21%. Despite the lack of concern in the mainstream, debt has consequences. Studies have shown that a debt to GDP ratio over 90% retards economic growth by about 30%. This throws cold water on the Republican mantra “we can grow ourselves out of the debt.”

A big chunk of the excess spending in FY2020 came courtesy of the $2.2 trillion CARES Act. But Uncle Sam was already spending money at a near-record clip before the pandemic. The coronavirus spending simply exacerbated an already out of control federal spending problem.

Last year, the Trump administration ran a $984 billion deficit. At the time, it was the fifth-largest deficit in history. This goes to show that the federal government had a major spending problem before the pandemic. In fact, through the first two months of fiscal 2020, the deficit was already 12% over 2019’s huge Obama-like number and was on track to eclipse $1 trillion. Prior to 2020, the US government had only run deficits over $1 trillion four times, all during the Great Recession. We were approaching that number prior to the pandemic, despite what Trump kept calling “the greatest economy in the history of America.”

No matter what happens in the 2020 election, the spending will almost certainly continue unabated. The Democrats have proposed another $3 trillion stimulus plan. The Republicans have pushed for a slightly lower number and have conceded the argument when it comes to a principled opposition to stimulus. The debate has devolved to how much to spend and where to spend it. The Republicans lost the argument the minute they accepted the false doctrine that stimulus is good. Basically, they were arguing the Democrats’ point that government spending helps the economy, that deficits don’t matter, that printing money doesn’t matter, that we can have all the government we want. We don’t even have to pay for it as long as the Federal Reserve prints the money. So, the minute they accepted the Democrats’ argument, they lost.

According to a recent CBO report, on the current trajectory, the size of the national debt will be nearly double the size of the US economy by 2050.

It’s easy to simply shrug off the debt. People have been warning about it for years. But it’s not a problem until it is. Debt is neither free nor is it irrelevant.

At some point, somebody has to pay for all this. As the saying goes – there’s no such thing as a free lunch. We are all on the hook for the massive bill. We (and our children and grandchildren) will pay for this down the road – either through higher taxes or higher inflation – most likely both.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]