This Is the Way the Dollar Ends

Peter Schiff has always emphasized that gold is a long-term safe haven asset and not a means of making quick profits. Investors need to understand the big economic picture to grasp why gold such an essential asset. Perhaps the biggest picture is the rise and fall of global currencies throughout history.

Jim Rickards, author of The Death of Money, walks us through the 20th century history of the US dollar and the pound sterling. He explains how a currency gains and loses the status of a global reserve currency.

The UK pound sterling had previously held the dominant reserve currency role starting in 1816, following the end of the Napoleonic Wars and the official adoption of the gold standard by the UK. Many observers assume the 1944 Bretton Woods conference was the moment the US dollar replaced sterling as the world’s leading reserve currency. In fact, that replacement of sterling by the dollar as the world’s leading reserve currency was a process that took 30 years, from 1914 to 1944.”

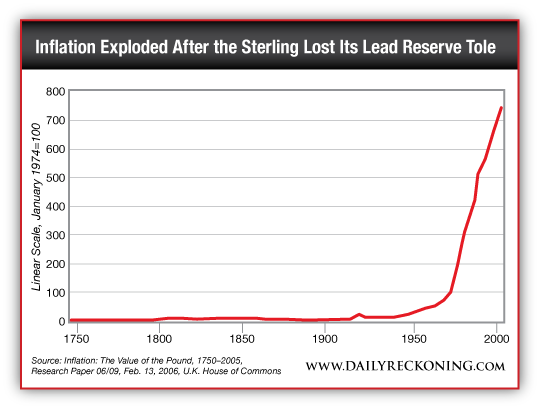

The effects of the pound losing its reserve status are striking. They can be summed up in one word: inflation. Here’s two bits of data to put the following chart in perspective:

- For 185 years ending at 1950, prices in the pound sterling increased 200%.

- In the next 70 years, pound sterling prices went up 5,000%

Essentially, a currency achieves global reserve status when it is controlled by a prosperous, creditor nation. This country usually amasses large reserves of gold, which act as a stable foundation to the currency. Indeed, the United States and its dollar became the economic engine of the world through the massive amounts of credit it extended during and after World War I and II. For the most part, gold flowed into the vaults of the Federal Reserve during this time.

However, today the tables are turning. The dollar has slowly been losing its reserve status:

Signs of this are already visible. In 2000, dollar assets were about 70% of global reserves. Today, the comparable figure is about 62%. If this trend continues, one could easily see the dollar fall below 50% in the not-too-distant future.

“It is equally obvious that a major creditor nation is emerging to challenge the US today just as the US emerged to challenge the UK in 1914. That power is China. The US had massive gold inflows from 1914-1944. China has massive gold inflows today.”

Yes, once again, the big picture returns to the transition of power from West to East. However, Rickards explains that this transition is quite different from the dollar’s dominance over the pound:

China is not alone in its efforts to achieve creditor status and to acquire gold. Russia has doubled its gold reserves in the past five years and has little external debt. Iran has also imported massive amounts of gold, mostly through Turkey and Dubai, although no one knows the exact amount, because Iranian gold imports are a state secret.

“Other countries, including BRICS members Brazil, India and South Africa, have joined Russia and China to build institutions that could replace the balance of payments lending of the International Monetary Fund (IMF) and the development lending of the World Bank. All of these countries are clear about their desire to break free of US dollar dominance.

Sterling faced a single rival in 1914, the US dollar. Today, the dollar faces a host of rivals — China, Russia, India, Brazil, South Africa, Iran and many others. In addition, there is the world super-money, the special drawing right (SDR), which I expect will also be used to diminish the role of the dollar. The US is playing into the hands of these rivals by running trade deficits, budget deficits and a huge external debt.”

We are living through the endgame of the US dollar. This process is almost impossible to reverse. Investors trying to predict when gold and silver will surge to new historic highs are missing this big picture. The only thing to remember is that one day we’ll look back and wonder at how gold could have ever been this cheap.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

[…] READ MORE […]