The True Cost of Higher Education & the Student Debt Crisis (Video)

Nowadays, the mainstream assumption is that everyone is better off getting a college degree, no matter what. The economics of this logic are actually far more complicated. In a detailed video analyzing the cost of higher education, Stefan Molyneux of Freedomain Radio reviews some important studies debunking this new American myth. Molyneux has interviewed Peter Schiff in the past, which you can watch here.

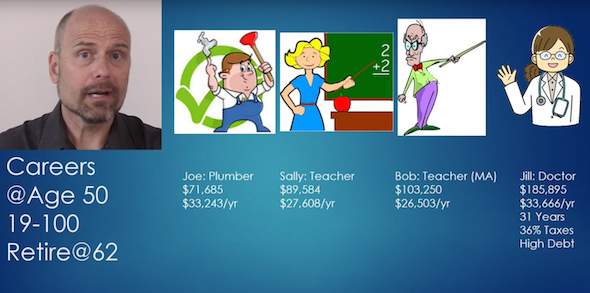

One of the most notable parts of Molyneux’s video begins at 23:30, when he compares the average salaries of various careers and the costs of achieving that career. For instance, a plumber at age 50 will earn about $71K a year with just a couple years of apprenticeship or trade school. Meanwhile, a higher-earning teacher with a master’s degree can achieve a salary of about $103K a year when they are 50 years old. However, when you take into account the lost work time for education, as well as the cost of student debt, a plumber ends up having about $33K a year of spendable income, while the teacher only has $26K. The disparity between salary and spendable income becomes even more dramatic with a doctor earning $185K a year.

These numbers are based upon a retirement age of 62 and come from a study conducted by Professor Laurence Kotlikoff of Boston University, which Forbes summarized here.

Enjoy Molyneux’s video below. If you don’t have an hour to spare, download our free white paper that highlights the key issues at play in America’s student debt crisis – The Student Loan Bubble: Gambling with America’s Future.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Thanks for the great info Samuel. I wish more people recognized the great work the folks at FDR are doing. Keep it up.

One thing that most people, who comment the “student crisis” are forgetting is that in many European countries it is economically better to be in college than not, because one is more employable as a student and also more flexible at the same time because of the employment regulations. Here in Slovenia (similar in CZ, CRO, AU, etc…) for example an employer can hire a student for min 5,8€/h (the Student gets 4,6€ nett) whereas the min. wage laws for everyone else is around 700€/month net (around 1400 gross) with much easier way of laying a student off (and hiring as well) than a non-student.

So in truth students in EU often go to school so that they can work, not study (besides they get a humungous amount of subsidies and they often don’t have to even pay a cent for school, and live at their parents…).

You didn’t take into account how much less the teacher works,vs the plumber.I would estimate that the teacher would work half the hours of the plumber,when you consider how much less the teacher works each day and the number of days off.This is even more apparent for college professors,that may “teach” about 15 hours a week.In my opinion,I would rather be working,assuming I enjoy my chosen profession,than be a bored teacher,many of whom hate their jobs,teaching indifferent students who aren’t interested in learning,just there for the degree.

A plumber bills me for 1 h of work 1,16 more than I earn per hour. I earn well enough to afford living in a golf estate, sending kids to private schools,etc.

I work 8 h/ day indeed, but the plumber works perhaps 10 or 12 hours, including weekends when he charges double.

The plumber makes more money than I. He still can send his kids to private schools, buy a villa, not too much time for holidays, but…

In a collapsed world the plumber will make more money that me, in any case. Lesson learned: I sent my kids to learn hand on jobs before they study for university (repair a car, fix the plumbing, build a wall, learn the value of Gold)