Shadow Stats: Gold Near Inflation-Adjusted Low

Peter Schiff has argued for years that government inflation data in the United States is bogus. The Federal Reserve and financial media focus on a broader measurement of inflation that overlooks the significant increases in the cost of living for most Americans. What’s more, the way this inflation is measured has changed dramatically over the years, further divorcing it from reality.

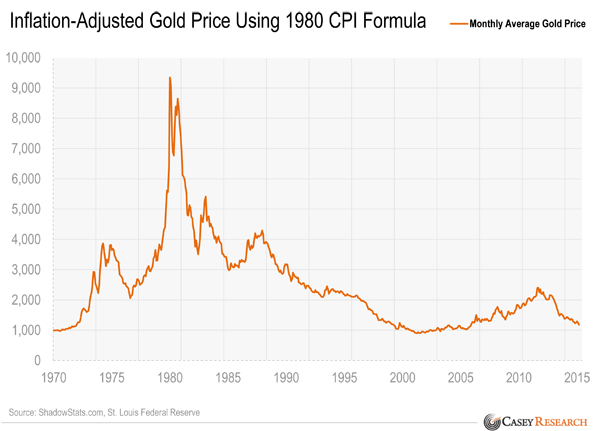

John Williams’ Shadow Stats is one of the best places to find a more realistic picture of US inflation. He uses a more accurate method from 1980 of calculating inflation in the Consumer Price Index.

Casey Research worked with Shadow Stats to chart the price of gold in inflation-adjusted dollars based upon 1980 calculations. The results are striking:

Adjusted for the 1980 inflation measure, the gold price is approaching its bear market low of 2001. In fact, gold is now below the 1975 price when it became legal to own it again!

“These data clearly show that when measured against a more realistic view of inflation, gold is dramatically undervalued.

“And with total worldwide debt levels up by a whopping $57 trillion since the end of 2007, the need to own it is as important as ever.

“Don’t worry about the current rangebound price. Buying now represents tremendous value and tremendous protection against the next economic crisis.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath. The Federal Reserve is often viewed as a neutral guardian of the economy, tasked with safeguarding employment and ensuring stable prices. However, the Fed is run by individuals who, like anyone else, are swayed by certain motivations. Do the people behind the Fed truly have the incentive to remain impartial? Our guest commentator demystifies the […]

The Federal Reserve is often viewed as a neutral guardian of the economy, tasked with safeguarding employment and ensuring stable prices. However, the Fed is run by individuals who, like anyone else, are swayed by certain motivations. Do the people behind the Fed truly have the incentive to remain impartial? Our guest commentator demystifies the […]

Leave a Reply