Rising Debt Is a Global Problem

An article from the New York Post pointed out that many analysts are joining Peter Schiff in saying that the global debt explosion is unsustainable. In fact, it’s pushing countries around the world towards yet another precipice of financial collapse. The Post cites some grim statistics of American and global debt:

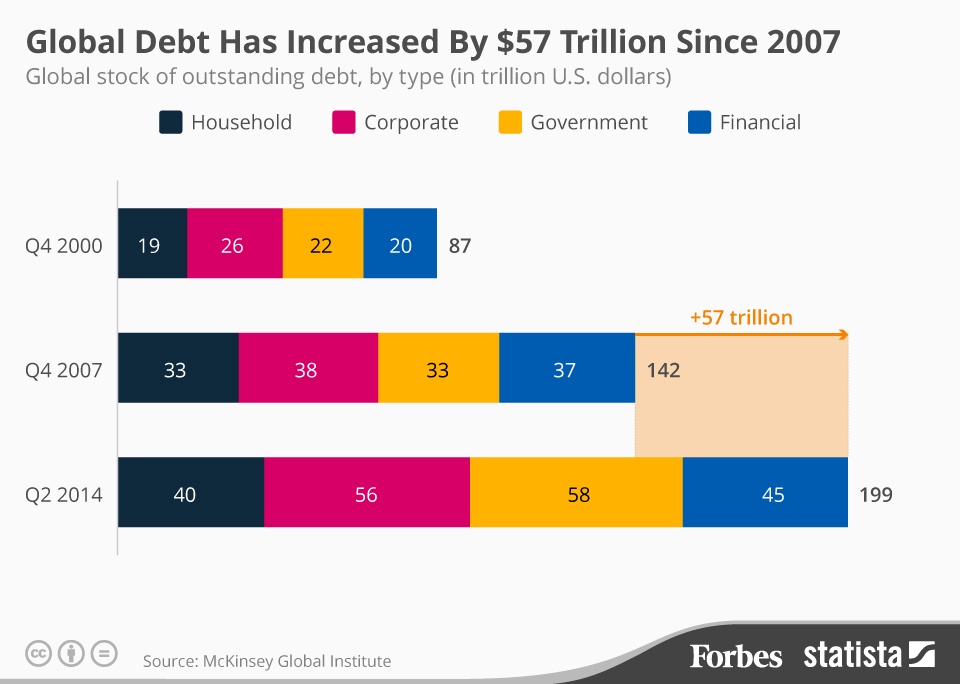

- Global debt has expanded $57 trillion since 2007, reaching a total of $199 trillion last year.

- Total US debt was $40 trillion last year, or 233% of US gross domestic product.

- Even the Atlanta Fed has cut its estimate for first-quarter GDP growth to 0.3%.

- Central banks in the eurozone adopted a $60 billion per month QE program, pushing bonds to an all-time low.

The Post quoted Peter’s warning that the upcoming financial crisis will be worse than the previous one:

The debts grow larger and larger because of our ability to postpone the consequences — and we are rapidly approaching the crisis that will dwarf the crisis in 2007 and 2008…”

This crisis won’t be limited to a select few. Anyone who owns a home or a credit card will be especially hard-hit:

The bogeyman is unsustainable debt, say analysts. The globe is overwhelmed with a ticking time bomb of debt… As the debt mountain expands, the threat of rising rates will hit various sectors especially hard, from homeowners on adjustable rates to credit-card holders, financial planners note.”

Peter points out that America’s GDP growth remains abysmal. We know that he believes it is likely to dip into negative territory as we enter a new recession. In this situation, there’s no foreseeable way for the country to pay off its debts.

It is impossible to stay ahead because there is no way GDP can ever grow as fast as the debt is growing… All the while the problems get bigger…”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Leave a Reply