Proof of the “Job-Sharing” Economy

In his new Gold Videocast, Peter Schiff explained how Obamacare has created a “job-sharing” economy that is skewing the government’s employment data. As he put it:

Obamacare forces employers to provide insurance for full-time employees. As a result, employers are hiring more part-time workers than they normally would and that is substantially influencing these numbers… [Suppose an employer] cuts [two full-time workers’] hours back to 10 hours a week and then he actually hires two more guys. So now he has four guys working 40 hours instead of two guys working 80 hours. He’s cut the hours in half but doubled his workforce. According to the government, he’s just created two jobs even though he has four people sharing one job.”

People are already wondering how Peter can know that job sharing actually takes place. Where’s the evidence that full-time workers are being laid off in favor of part-time labor? All you have to do is look at the numbers released by the Bureau of Labor Statistics.

For instance, look at June of 2014. The BLS reported that 799,00 part-time jobs were created, while 523,000 full-time jobs were lost. To the casual observer, it looks like nearly 276,000 jobs were created.

Peter isn’t the only one observing this trend. The CEO of Gallup recently exposed the crooked math behind the BLS job reports. Beyond trading part-time for full-time jobs, there are a lot of other problems with the numbers.

John Manfreda explains in detail in his recent commentary:

On Friday, February 6th, the Bureau of Labor Statistics (BLS) reported an unemployment rate of 5.6 percent. This sounds great on the surface, but Gallup’s CEO said it best; the unemployment rate is a “big lie.”

According to Gallup CEO Jim Clifton, if one hasn’t been working for four weeks or actively looking for work, one isn’t counted as unemployed. Also, if you work one hour a week, or get paid at least $20.00 a week, you aren’t counted as unemployed. This explains why 30 million Americans are out of work or severely unemployed.

What also helps explain the low unemployment rate is that nearly 22 million Americans are under-employed. This means is that if you are working part-time because you’re unable to find full-time work, you’re still counted as employed. Or if you have a PHD or Masters, but work as a cashier, you are considered employed.

The BLS also counts part-time and temporary work as jobs created. Currently, 44% of Americans work 30 hours or more a week. Most people in Human Resources (HR) consider a full-time job that of 40 hours or more. If a company hires 2 temporary workers and lays off a full-time worker, the BLS counts that as one job created.

As an example of this, in the June 2014 jobs report, 523,000 full-time jobs were lost, but 799,000 part-time jobs were created. This netted a gain of over 300,000 jobs.

In fact, since the “recovery” began, most of the jobs created were part-time. In 2013, 75% of the total jobs created were part-time jobs. This is why two-thirds of Americans are now living paycheck to paycheck.

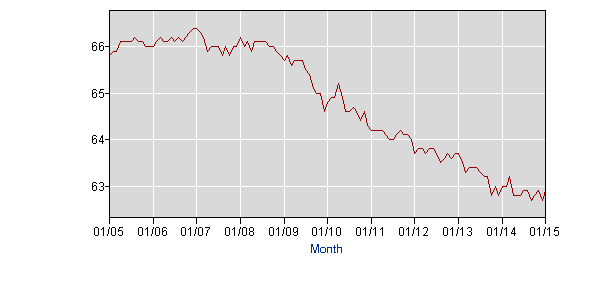

These doctored-up numbers aren’t the only reason the unemployment rate has declined. Look at this labor participation rate chart from the BLS.

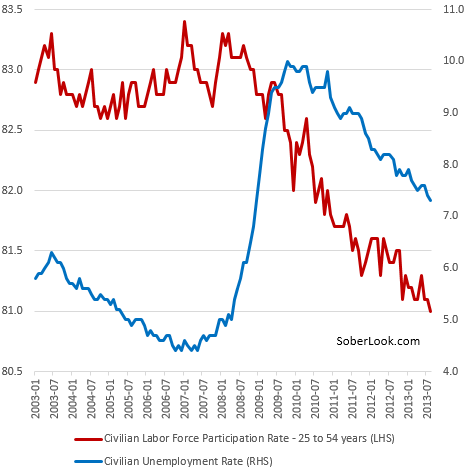

You can see the labor participation rate has declined drastically starting from the year 2009. Look at this chart below.

When looking at the chart, one can see the decline in the unemployment rate correlates with the decline in the labor participation rate.

On February 6, when the BLS announced the job data, it claimed that only 1900 jobs were lost in the energy patch. Meanwhile, Gary Christmas said that 21,322 jobs were lost. Why didn’t the BLS count those jobs?

As you can see, the unemployment rate is just masking the true dire state of the US economy.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath. The Federal Reserve is often viewed as a neutral guardian of the economy, tasked with safeguarding employment and ensuring stable prices. However, the Fed is run by individuals who, like anyone else, are swayed by certain motivations. Do the people behind the Fed truly have the incentive to remain impartial? Our guest commentator demystifies the […]

The Federal Reserve is often viewed as a neutral guardian of the economy, tasked with safeguarding employment and ensuring stable prices. However, the Fed is run by individuals who, like anyone else, are swayed by certain motivations. Do the people behind the Fed truly have the incentive to remain impartial? Our guest commentator demystifies the […]

Leave a Reply