Slowing Sales Point to Slowing Economy

If the Federal Reserve is truly “data dependent,” then the data just keeps undermining its case for an interest rate hike this year. Wholesale inventories rose in August, and sales fell, flashing a recessionary warning sign.

According to the Associated Press, the Commerce Department reported wholesale inventories rose 0.1% in August, while sales fell a full 1%.

The dip in sales follows a general year-long trend, with the number dropping 4.7% over the past 12 months.

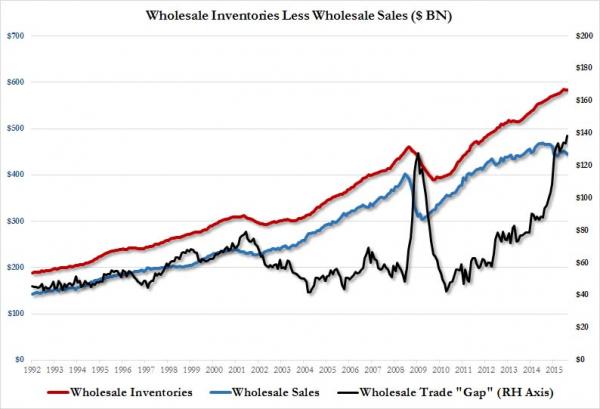

Meanwhile, inventories have increased 4.1% over the last year. Wholesale inventories currently stand at a seasonally adjusted $583.9 billion.

Reuters reports the rise in wholesale inventories was higher than expected. It was the largest increase in the last seven months:

Inventories for durable goods climbed 0.3 percent, with computers up 1.9 percent. At August’s sales pace it would take 1.31 months to clear shelves, up slightly from 1.30 months in July.”

This inventory-to-sales ratio is particularly troubling. It represents a new cycle high, and according to Zero Hedge, the absolute dollar spread between inventories and sales has never been higher.

Even Reuters admits this has the potential to weigh heavily on the economy:

An inventory-to-sales ratio that high usually means an unwanted inventory build-up, which would require businesses to liquidate stocks. That in turn could weigh on manufacturing and economic growth.”

The AP story on the rise in wholesale inventory includes some uncharacteristically pessimistic reporting, putting the numbers in a context suggesting broader problems in the US economy:

Hiring has suddenly slowed. Employers added just 136,000 workers in August and 142,000 in September, well below the 3-month average of 324,333 at the end of 2014. Sales of existing homes have also fallen after strong gains earlier in the year.”

Peter Schiff provided in-depth analysis of the dismal jobs report when it came out earlier this moth.

As we reported late last month, consumer data isn’t nearly as rosy as pundits would have you think either. Despite government reports indicating increased consumer spending, a Gallup poll asking actual people about their spending indicates a continual decline. According to the poll, daily spending averaged just $89 in August, down from the same time period in both 2014 and 2013. It was the fourth month in a row the poll indicated a year-on-year decline. Spending was at its lowest since March, based on the poll.

Falling sales and rising inventories seem to back up Gallup’s numbers.

All of these signs point to the fact that the US economy may well be sliding toward recession.

This post is part of our ongoing series Data Dependent: Reading Between the Lines, where we examine the real economic data not reported in the financial media. Click here to read all our articles in this series.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Here is a summary of some of the significant economic data/news that came out last week. Third-quarter 2019 new orders for durable goods remain on track for a second annual decline. August 2019 Real New Orders for Durable Goods showed a monthly gain of 0.2% [1.0% ex-Commercial Aircraft], but an annual decline of 4.9% [down […]

Here is a summary of some of the significant economic data/news that came out last week. Third-quarter 2019 new orders for durable goods remain on track for a second annual decline. August 2019 Real New Orders for Durable Goods showed a monthly gain of 0.2% [1.0% ex-Commercial Aircraft], but an annual decline of 4.9% [down […]

Leave a Reply