Worst Economic Data Since 2008 Crisis (Audio)

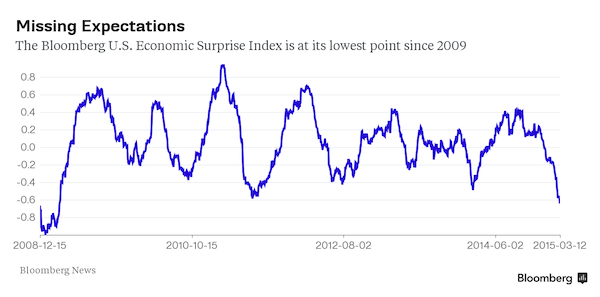

The Bloomberg ECO US Surprise Index is at its lowest since 2009, which means that forecasts for economic data haven’t been more wrong for six years. Bloomberg asks, “Is this a sign of unanticipated weakness in the economy?” At first, it seems like the mainstream media is actually waking up to the fact that the American economic recovery is bogus. However, the piece goes on to give a number of excuses for why nearly every piece of economic data beyond jobs numbers can be ignored.

Peter Schiff, on the other hand, has been answering Bloomberg’s question directly for months — yes, this is a sign of economic weakness and no, it’s not unanticipated. In his latest podcast, Peter asks the bigger question: Apart from employment figures, why are we seeing some of the worst economic data since the depths of the 2008 financial crisis?

Highlights from Peter’s podcast:

“The foreign exchange markets continue to ignore the darkening economic picture here in the United States. I think the dollar enjoyed one of its best weekly gains in years…

“I keep hearing people talk about, ‘Well, we can ignore all this bad economic data, because we’ve got the jobs report. The jobs report is strong, and so therefore the economy must be strong and we can ignore all of the economic data that suggests that the economy is weak…’

“It seems to me, and I’ve said this before, that the jobs numbers look like the outlier. When all the other data is bad, when all the other data says ‘white’ and the jobs data says ‘black,’ why aren’t people questioning the validity of the jobs numbers? … I’ve pointed this out many times, about what is wrong with the jobs numbers… Yet people still want to remain fixated on this and blindly ignore everything else…

“On Thursday, we got the February retail sales… Everybody is betting on the consumer… [Lower gas prices are supposed] to be reflected in retail sales. That’s what everybody was thinking. The forecast was to break the string — we had two declines in a row… The markets were looking for a positive February… That’s not what we got. Instead of up 0.3, we got down 0.6. We’ve had three consecutive months now of declining retail sales. The last time that happened, it was during the Lehman Brothers days — the financial crisis of 2008. That’s how far you’ve got to go back to find 3 consecutive months of declining retail sales. This is not the only data point where you have to go back to the financial crisis to find something this bad…

“Why are we printing numbers that we haven’t experienced since the depths of the 2008 financial crisis? …

“The debt ceiling that we suspended a year ago, I think that suspension is up next week. Congress needs to do something to kick the can down the road. I’m sure they’re going to… They raise the debt ceiling for fiscal responsibility: ‘America always pays its bills, so we have to raise the debt ceiling.’ But that’s not paying your bills… Paying your bills is paying them off. They go away… You don’t pay your Visa with your MasterCard…

“Despite the weakness in foreign markets and the strength of the dollar, the gold market pretty much held steady these last couple of days. In fact, it was up a couple of bucks today in dollars, which means it was really up in terms of euros, Canadian dollars, Australian dollars, Japanese yen, British pounds — you name the currency other than the US dollar and gold was up on the week…

“In addition to the retail sales numbers, we got the business inventories numbers, which were flat in January. They were looking for a slight increase, but this was the 8th time in nine months that the inventories were below estimates. What’s really important… is the inventories to sales ratio, which is now the highest it has been since 2008. That is a very, very weak sign that everybody is ignoring. Why is this ratio so high? It’s because businesses are not selling their products. In a strong economy, you actually see inventories rising, but not the inventories to sales ratio, because… they’re also selling…

“The Atlanta Fed reduced their estimate of 1st quarter GDP down to 0.6… We haven’t even got the second revision for the 4th quarter, which could very well be revised down to less than 2%. So we could have a sub-2% fourth quarter, a sub-1% first quarter, yet Wall Street is already excusing it and blaming it on the weather…”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Leave a Reply