Swiss Play Financial Hot Potato with Negative Rates

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Check out this article on an absolutely mind-boggling phenomenon taking place in Switzerland. Apparently Local Cantons (what states are apparently called over there) are actually telling taxpayers not to send the money they owe in to the government – at least not right away. They’re saying just hold on to the cash until the deadline.

What could possibly be a good reason for Leviathan to not want its food/funding ASAP? Well, when you live in a land of negative interest rates, things get a bit tipsy turvy. I guess it’s a bit like bizarro-world from that episode of Seinfeld – where up is down and bad is good.

As the article states:

The longer it has cash on its books, the more likely it will incur costs as a result of negative interest rates charged by Swiss banks. The canton calculates that the move will save SFr2.5m ($2.5m) a year.”

You see, instead of cash in the bank being an asset, suddenly it becomes a liability. Instead of it earning interest and giving you a solid payout, negative interest causes you to actually lose money as it sits in the bank. Hence the Swiss government saying – you guys hold on to those funds (and pay the negative interest instead of us) a bit longer. It’s like a crude game of financial hot potato. Whoever gets stuck with the cash in the bank loses.

As anyone with even a modicum of common sense (i.e anyone who is not a mainstream economist) will tell you this doesn’t seem right. And they’d be right. Because this is indeed not right at all. This is in fact a signal of looming disaster for the Swiss franc and its financial system. These negative interest rates are the death knell of their currency.

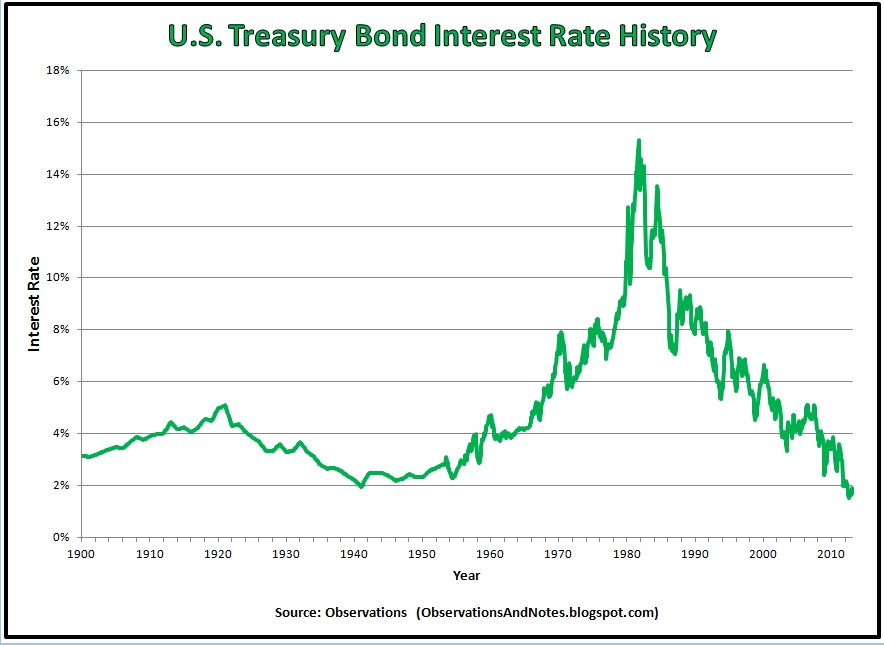

And sorry to say but this isn’t going to be a disease isolated to Europe. This negative interest rate-itis is coming stateside. Rates have been falling for 34 years after all, and they will keep going.

Why? Because interest rates are supposed to be set by the free market and as such should tend towards equilibrium. (Just to review briefly how it should work…when people want to borrow this will push rates up as it makes funds more scarce and when a firm can’t afford high rates of borrowing because a particular project won’t be profitable enough this will pressure them down. And if people don’t like the rate of interest they’re getting at their savings account given the risk they’re undertaking by lending it to a third party, they can withdraw their money – and stuff it in a mattress. This pressures savings account interest rates back up.)

Our financial system, however, is not free. Our money is a clever fabrication- a piece of debt called the dollar whose supply is controlled by a small cabal. As a result, it doesn’t matter whether I borrow funds or not, it will have zero effect in rates for others – as rates are set by the Fed. This is why they have not tended towards equilibrium. People keep borrowing and borrowing and debt is skyrocketing but interest rates keep falling.

As I mentioned interest rates at least under an honest money currency regime (gold) should tend towards equilibrium. So look at this chart again-(same as before) does that look like equilibrium? Or a system out of wack like a sound system with a positive feedback loop starting to emit an excruciating sound? Or a car swerving back and forth worse and worse till it flies off the side of the road? Clearly it is the latter. Obviously, then, something bad will result.

The fact of the matter is fiat currencies fail as they are based on lies and deception which cannot withstand the test of time. As Peter has said many times, the dollar will fail. Maybe not tomorrow. But we are well on our way. And there is no going back. So buy real money -physical gold and silver – while you still have the chance.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Leave a Reply