Negative Interest Rates a Sign of Imminent Collapse

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

With apologies to Freddy Mercury and Queen, it looks like another one has just bit the dust.

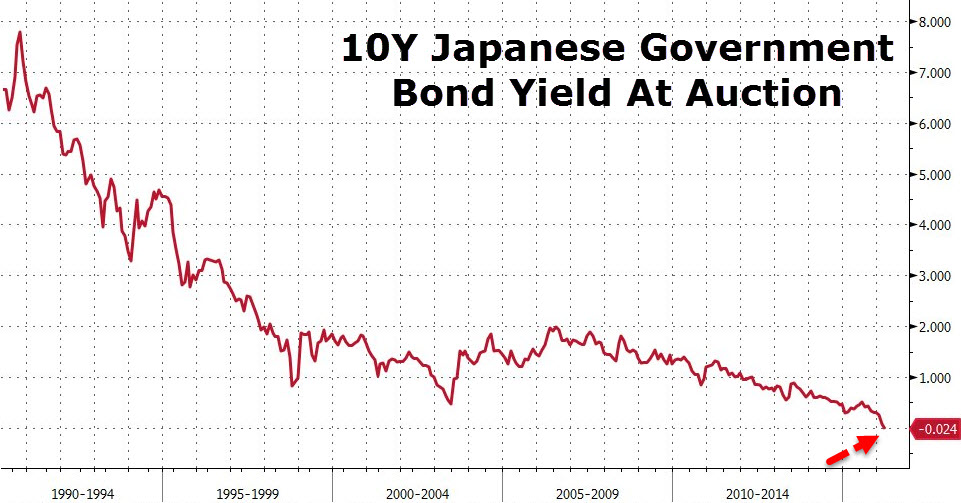

You can now add the Japanese central bank to the list of banks that have ventured deep into negative interest rate territory with the sale of a negative rate bond.

The Swiss are already languishing in that territory with negative rates out on their 20 year bond – if you can believe it. Steve Barrow, a G10 strategist at Standard Bank tells us that there will be others soon enough. He contends that, “Germany will get there as well, and yields will continue falling, going negative where they aren’t negative.”

Negative rates aren’t just the latest strategy to stimulate growth being pulled out of central bankers’ toolboxes. They are the end-game of the international monetary system as it effectively destroys capital.

And negative interest rates are a clear signal that collapse is not only coming, it is imminent.

The gold and libertarian community likes to fixate on inflation as though that’s the key indicator of impending collapse. It is not. Inflation can be affected by a myriad of things – including economic downturn. Just because a hyperinflation isn’t happening doesn’t mean the system isn’t foundering and inching towards destruction. Interest rates are actually a better indicator of this.

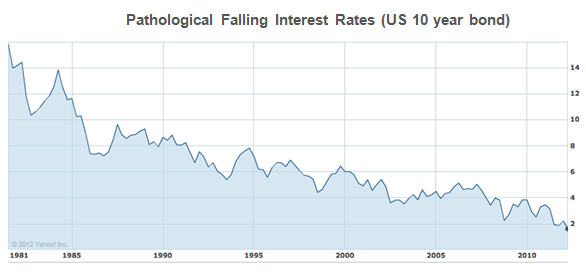

You’d like to think that the US Federal Reserve is immune to such influences—except they just tried to raise rates in December, and yields still went down afterwards. In other words, the Fed is not in control. No central bank is.

US interest rates have now been pathologically falling for over three decades and we are past the point of no return.

Be prepared for the worst.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.  It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […]

It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […] In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up. When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]

When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]

Virtually the gold price remains stable for many centuries

though the quantity of money you need to buy gold

changes from time to time. With the prevailing uncertain economic conditions, many people are seeking ways to invest

in gold as security against negative inflationary activity and

as a safe, high-value investment portfolio haven. Not dumping our men and material down a bottomless fox hole

in Europe (or Korea, Viet Nam, Afghanistan or Iraq for that

matter).