May Jobs Report Shockingly Bad

This article was submitted by JD Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Last Friday, the BLS released its jobs report for the month of May.

It was shockingly bad.

In light of the strike on Verizon, a relatively weak report of 170,000 jobs was expected; however, the report delivered far below expectations with just 38,000 jobs created. The new data, detailing the worst jobs numbers in nearly six years, is also accompanied with downward revisions of earlier numbers. The BLS revisions of employment figures for March and April puts the economy with 59,000 less jobs than previously reported.

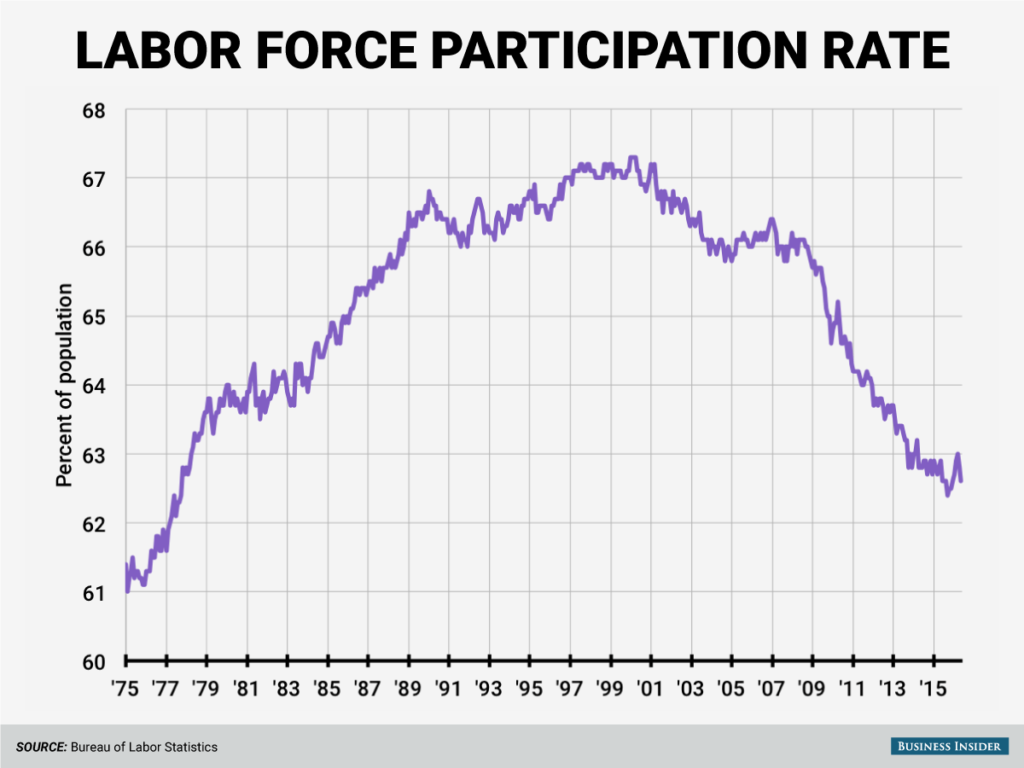

The labor force participation rate also decreased as 660,000 more workers left the labor force. The current participation rate of 62.6% is nearly the lowest the US has seen in the last four decades.

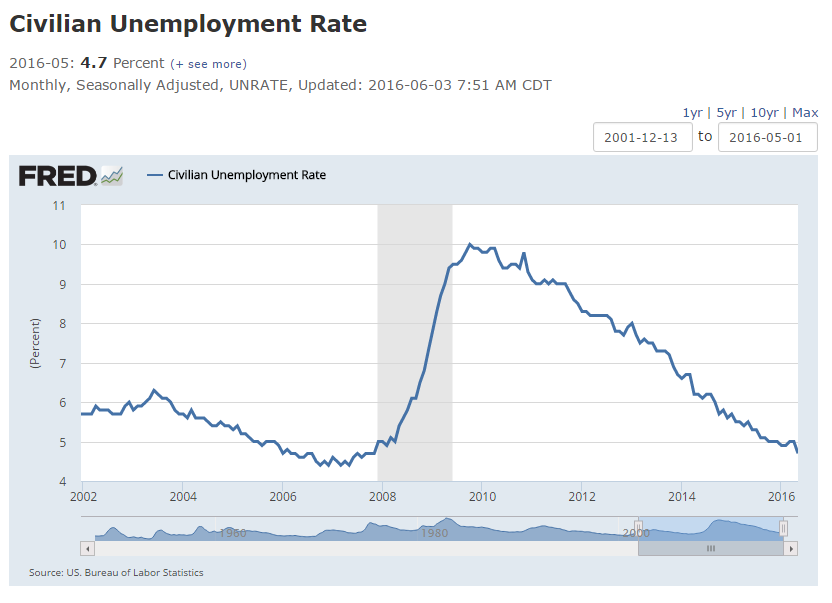

Amazingly, following this dismal report the official government unemployment rate went down to 4.7%, the lowest since the Great Recession of 2008. A smaller workforce, of course, means a lower unemployment rate. It just goes to show how unhelpful these statistics are in actually gauging the true health of an economy—and how deliberately deceptive the government and media are for using them.

Keep up with the latest trends and their impact on the gold market. Subscribe to Peter Schiff’s Gold Videocast

The weak jobs report also sheds light upon macroeconomic projections, indicating serious weakness in economic growth and a high likelihood that the Fed will not raise rates this summer, despite its previously hawkish remarks in the April minutes announcement.

“This was quite shocking – it’s way under expectations,” said Christopher Sullivan, who oversees $2.3 billion as chief investment officer at United Nations Federal Credit Union in NY. The Fed “will postpone a nearby rate hike for sure — maybe they’ll be forced to look beyond the summer.”

In reaction the jobs report, Bloomberg reports a fall in the dollar and stock prices, accompanied by a rise in both bond and gold prices. Following the release of Friday’s jobs report, the gold spot price rose $33.10 and closed at $1243.50 an ounce for the weekend. With new evidence of a faltering economy, investors are continuing to reallocate their portfolios into safer assets like gold.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.  It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […]

It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […] In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

Leave a Reply