Maximizing Your Metals Holdings Using the Gold-Silver Price Ratio (Part 2)

This article was written by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

In Part 1 of Maximizing Your Metals Holdings Using the Gold-Silver Price Ratio, we briefly went over what the gold-silver ratio is, and how it tends to fluctuate up and down over time.

Generally speaking, the ratio tends to rise (gold becomes more valuable versus silver) during metals bear markets, and it tends to fall (gold becomes less valuable versus silver) during bull markets. This is due to the fact that silver is more volatile. As mentioned at the end of part I, by focusing on this ratio, and exchanging and trading holdings of one metal for the other at key points, investors can actually maximize gold holdings.

(A quick disclaimer – SchiffGold does not recommend the trading strategy explained in this two-part article. Some sophisticated traders of gold and silver do employ it to increase their gold holdings. I’m writing about this, because SchiffGold believes gold investors should be aware of the long-term relationship between gold and silver and the implications of this price ratio. You can read more in our free special report – The Powerful Case for Silver.)

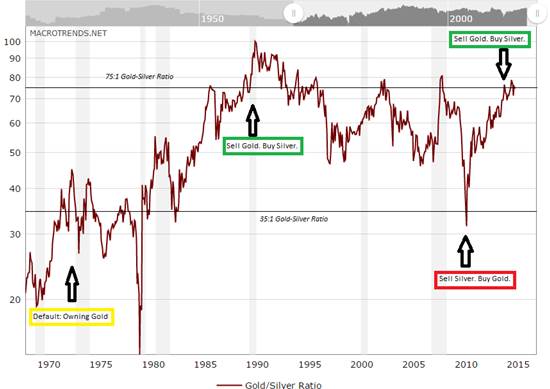

A basic but dependable way to implement this strategy is to pinpoint generally the levels at which gold is overvalued versus silver and vice versa.

Over the last 40 odd years the average silver:gold ratio was roughly 54:1. This tells us that when an ounce of gold is about 54 times the value of an ounce of silver, the metals are essentially fairly valued. Extending upwards and downwards about 20 notches gives us a conservative estimate of gold being very overvalued at a ratio 75:1 and silver being overvalued at a ratio of 35:1.

Bron Suchecki at the Perth Mint picks levels of 75:1 and 45:1 as significant points. While the numbers are slightly different, the fundamental principles are the same.

Imagine for a moment you bought 100 ounces of gold around 1974, but instead of just sitting on it for the past 40 years, you waited until gold was clearly overvalued versus silver – vis-à-vis a 75:1 gold-silver ratio — and then sold it, purchasing as much silver as you could with the proceeds. Then, when the ratio plunged back down again and reached 35:1, you sold your silver holdings, and re-purchased as much gold as you could with the proceeds.

The chart below depicts your trading activity:

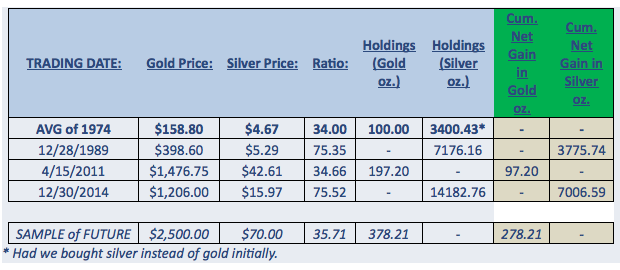

This table details the results – along with those from a theoretical projection into the future.

Note: We begin in 1974 (using the average prices of gold and silver for the year), as this was when the Bretton-Woods monetary system ended and US citizens could once again purchase gold freely. The assumption here is that we’d just purchase gold to start and no silver – gold being the primary monetary metal. Every time the gold-silver ratio eclipsed the limits of 75:1, we sold our gold holdings and bought silver. When the ratio then fell again past 35:1, we sold our silver and bought gold. Each time we purchased metal it was assumed that there was a 5% cost above the spot price. Each time we sold, it was assumed that we received 100% of spot price (i.e. 0% below spot). In other words, the spread from buying to selling was assumed to be 5%. Capital gains taxes were not taken into consideration. Lastly, I am deliberately not measuring profits in terms of dollars. Dollars are just debt, not true money. Therefore, we measure profits in terms of the number of extra gold and silver ounces accumulated.

The results are impressive.

Had you traded your gold and silver according to this indicator, you would have accumulated nearly twice as many ounces of gold by 2010 – an extra 97 ounces – compared with simply sitting on your 100 ounces. By the end of 2014, instead of owning just 3,400 ounces of silver (had you bought silver instead of gold originally), you would now own over 14,000 ounces —a profit of over 10,000 ounces of silver. Keep in mind, of course, these profits are in ounces of metal and NOT dollars. It is possible you could accumulate more ounces of metal and yet decrease your holdings of total dollars.

This strategy does not involve rapid, risky day-trading. This is through a simple, measured and extremely conservative approach. Years can sometimes go by between trades. The fact is, every time the ratio moves between these two designated levels, you end up nearly doubling your holdings.

So what’s the big takeaway?

As illustrated here, paying close attention to the gold-silver ratio and trading your metal at key moments yields a substantial profit. But it is not just in dollars. Rather it’s in terms of real money: ounces of gold and silver.

Given the fact that it can take over 10 years for the ratio to adjust and trade the metals, for those who have a short time horizon of investing, it would be wiser to avoid trying to trade the ratio and just stick to investing in gold, as it has historically had much lower volatility than silver.

At SchiffGold, We Can Help You Trade the Metals

Unlike many precious metals dealers, at SchiffGold, we not only sell gold and silver, we readily buy it back too – even if we didn’t sell it to you in the first place. We are one of the premiere two-way market-makers in the industry. Not only that, we have a team of intelligent, thoughtful, and dedicated experts ready and willing to offer you guidance as to how to purchase metals with the gold-silver ratio in mind.

For example, you might be wondering at this point: what is the current gold-silver ratio right now? You can track the ratio in real time on our Price Charts page. Right now, it is sitting pretty right 77.04 (as of January 27). It is well above the 54:1 average ratio of the past 40 year. Therefore silver looks to be the undervalued metal at this time. In other words, now is a perfect time to buy silver and start taking advantage of the gold-silver ratio signal.

Learn more about the gold-silver price ratio in our FREE special report:

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.  It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […]

It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […] In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up. When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]

When John Bogle died in 2019, people around the world mourned. Bogle created the Vanguard Group and made the index fund mainstream. Index funds are investment vehicles that invest in a class of investments as a whole, rather than trying to predict what specific stocks or securities will do best. So an investor could invest in an […]

Leave a Reply