Janet Yellen’s Bluff and Mario Draghi’s Hubris

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The monetary landscape of today looks pretty grim. We are in the middle of the perennial decline in the rate of interest. Central bankers are convinced they can get us all out of this mess. But can they really?

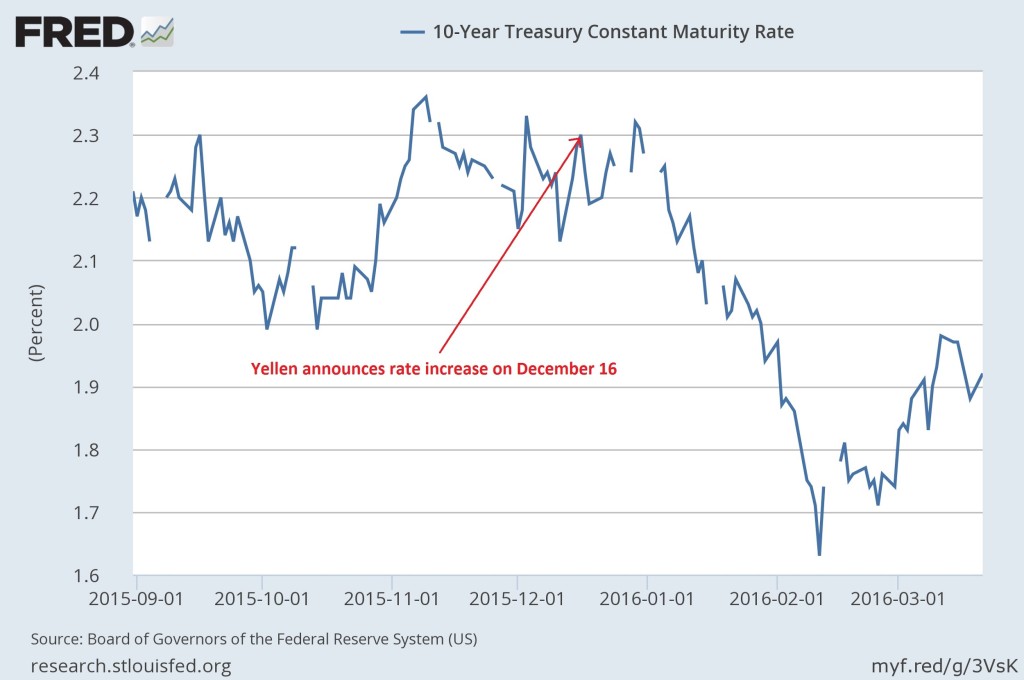

Janet Yellen timidly tried to go against the decade long trend by raising rates at the end of last year. It has not panned out so well. In fact, rates actually declined despite her announcement and subsequent plan to keep raising rates throughout the year.

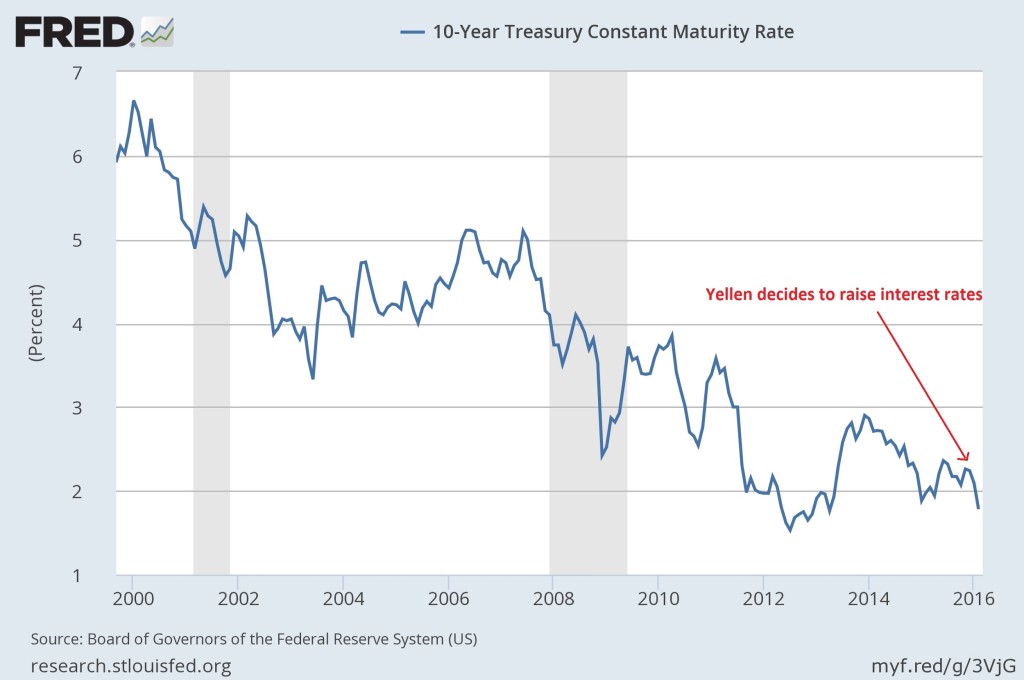

Zooming out a bit we get a much clearer picture of the long term trend.

Yellen: “Raise rates? Yeah, we can raise rates, no problem!”

In the game of poker, this is called a bluff.

If it’s not obvious already, it should become very obvious soon. Central bankers have a lot less influence over the rate of interest than they lead us to believe. But this is not to say they have no influence whatsoever. They most certainly do. And every bit they have they most certainly should not if we really want free markets for money and credit.

This proves true if you look at the Fed’s track record on the other side of the interest rate as well. Under Bernanke’s regime the Fed supposedly “lowered the interest rate” several times post 2007-2008. However, again if you zoom out a bit, a different narrative starts to emerge. The following chart, courtesy of Keith Weiner, shows that the interest rate has been in a long term falling trend since the late 70’s and early 80’s.

Again, with this long term view in mind, it becomes apparent that the Federal Reserve, along with everyone else, finds themselves swept up by a powerful long term trend with no really good answers or plans for how to get out from under it. It should be clear by now that the Fed will often will follow the broader market, not lead it. This quote by Alhambra Investment Partners drives this point home:

For the Fed does not lead, it follows. It follows the market because frankly it can’t be any other way. The Fed is not now nor has it ever been sufficiently powerful to overcome the market and force it to bend to its will. And last week we got more evidence that despite decades of practice, years of trial and error, the torturing of mounds of data with ever more powerful processors, the Fed still hasn’t mastered this forecasting game any better than the aggregated opinion of millions of traders and investors embodied in what we call ‘the market.’”

For anyone who was seriously hoping that Yellen’s announcement would signal the turnaround in the US economy, or even in interest rates, has to be deeply troubled by this point. Interest rates aren’t going anywhere but down. Negative interest rates are already a reality in Europe and in Japan. There is little doubt that they will eventually make their way to the US. Yellen has even hinted at this possibility. This all serves to cast a shadow of doubt over the ability of Central Banks to actually make good on their promises.

Download Free: SchiffGold’s Guide To Tax-Free Gold & Silver Buying

Having focused on Yellen, let’s now turn our attention to Mario Draghi at the European Central Bank. Undoubtedly, Draghi has a different personality than Yellen. He carries himself with bravado and tends to make bolder pronouncements. Perhaps Draghi’s most famous and defining moment was in the summer of 2012 when he appeared in public and dramatically pledged “ to do whatever it takes to preserve the euro, and believe me, it will be enough.”

Closing in on four years later, no one can doubt that Draghi has certainly done a lot. In fact, during his tenure as the President of the ECB, nearly one out of every four policy meetings resulted in some kind of monetary stimulus package. Yet, at the end of the day, what does the Euro and the Eurozone have to show for it? How exactly can Draghi’s hypothesis of preserving the euro be validated? And at what cost? If we use his own metrics, he is still way short of the stated 2% inflation target. Official inflation levels have consistently been coming in at near zero and have even been reported at negative levels a few times. They currently stand at around 0.2%. That’s a long way from 2%. This despite repeated use of “unconventional measures” in order to achieve those stated goals, which at some point will have to be unwound. Nobody really knows what that is going to look like, but given the magnitude of stimulus we have seen thus far, it promises not to be so pretty.

There are a lot of problems with the euro and the Eurozone. Some of the euro problems are unique to the euro, while others are the same fundamental problems that the dollar has here in the US. Despite their personality and geopolitical differences, both Yellen and Draghi share one problem in common – they are both caught up in forces far greater than the power they each individually or collectively possess. Yellen can’t make an interest rate rise or fall and Draghi can’t lift up the inflation rate no matter how hard he huffs and puffs. They are both working against years of powerful momentum put in motion long before they took their oaths of office. Like Gandalf said in the Mines of Moria scene, “This foe is beyond any of you. RUN!”

Who is the balrog? The balrog is the eventuality of a closed loop debt based currency system which is void of any feedback mechanism for how the interest rate is set. And that void, is exactly where interest rates, and fiat currencies themselves are all going to end up.

Empty.

Just like the promises of our central bankers.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

Epic, such a well written article. I can’t wait to see what happens. Enough of this interference in the markets, STAY OUT OF THE FREE MARKET. I am not waiting to see what happens to people though, their lives will be ruined :-[