What Are the Best Silver Products to Buy?

This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article is a comprehensive breakdown on SchiffGold’s most bought/sold silver products. I give my personal comments on each product and I give a brief final analysis to help buyers pinpoint the exact product that meets their goals and objectives.

Additionally, I wrote this for buyers seeking to take delivery or possession within the United States. International markets value some products differently. For clients seeking international silver holdings I recommend talking to your precious metals specialist.

Lastly, every silver product mentioned in this article is approved and sold by Peter Schiff’s company SchiffGold. These products are liquid, investment grade, and non-numismatic products. SchiffGold does not and has never endorsed the buying of numismatic products. (For more info on numismatic products and the scams associated with them read Peter Schiff’s “Classic Gold Scams” report).

Historical Silver Product Bids

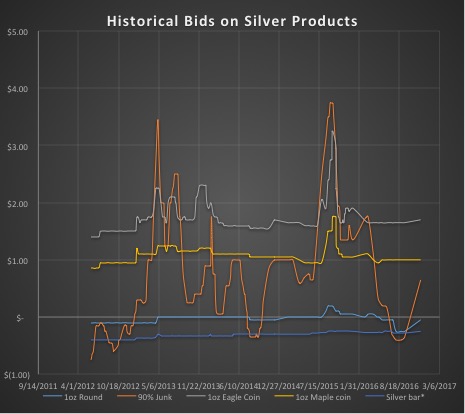

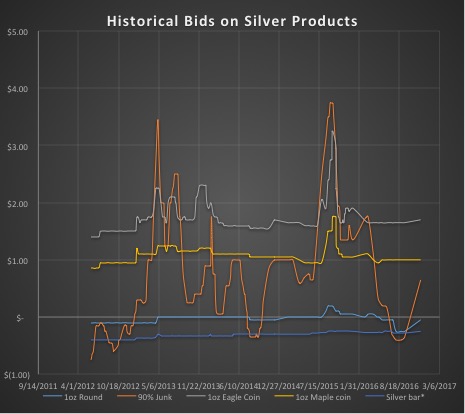

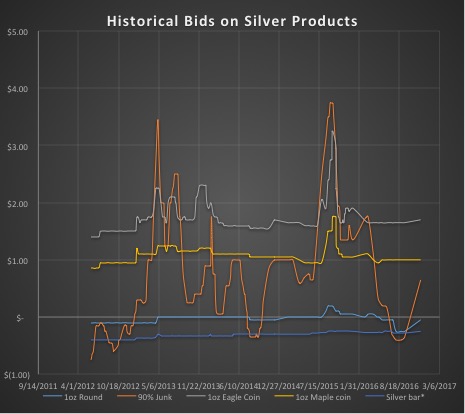

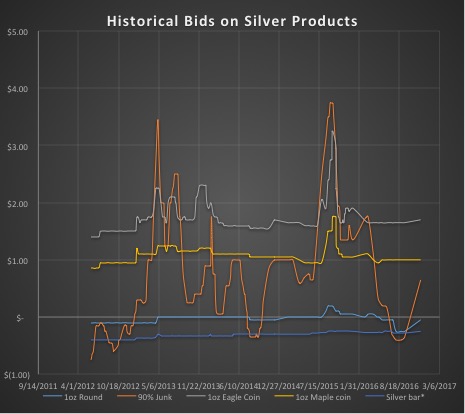

In the above graph, the “Silver bar” title represents a rough average between 10oz, 100oz, and 1000oz silver bars. The exact bid for the product will depend on the product brand, condition, and location. The graph was created with data compiled from SchiffGold’s internal bid quotes dating from 6/4/2012 – 12/2/2016. These quotes are approximates for this educational article, they are NOT official quotes. The exact bid for the product will be given by your precious metal specialist and will depend on the product brand, condition, and location.

About the graph

The bid graph above features the historical bids for SchiffGold’s top silver products. Knowing the bid on silver is a little more complicated than knowing the bids on gold products, which are almost always the same. Unlike gold, silver’s bid prices change frequently. For readers unfamiliar with the term “bid” or do not understand the importance of the bid price, I recommend reading my recent post “Smart buyers know the bid before buying”.

How to read the graph:

Physical silver bids are always relative to the spot price. For example, a bid of $1.60 on 6/10/2014 for an American 1oz Silver Eagle coin means SchiffGold was offering clients a premium of $1.60 over the spot price. Given that spot was $19.10 on that particular day, a client could sell their silver eagles for $20.70 per coin ($19.10 spot + $1.60 premium).

Physical silver bids might be below the silver spot price. It is typical for large silver bars to have bids under spot. For example on 7/15/2015 a client could sell a silver bar for $0.27 under the spot price. Given that spot was $15.20 on that particular day, a client would receive $14.93 per ounce of silver ($15.20 spot – $0.27). I reference this chart throughout the product analysis below.

Silver Product Analysis

Silver 1oz American Eagle coins

Purity – 99.9%

IRA approved – Yes

Liquidity – High

1099B exempt – Yes

Comments:

The silver eagle is considered by many to be the most beautiful coin in the world. The U.S. mint started minting these coins in 1986. They were minted after the IRS set up the 1099B reporting requirements in the early 1980s, hence eagles are exempt from reporting. For more information on 1099B reporting read our Tax-Free Buying Report.

Silver eagles are packaged in mint sealed tubes of 20 and are placed inside a U.S. mint sealed “monster box” totaling 25 tubes. Since silver eagles are minted by the U.S. mint and they feature the iconic walking liberty design. Naturally they have become the most recognized silver coin in the United States. This makes them one of the best if not the best “doomsday” coin, because everyone knows the silver eagle. In the case of a currency crisis, in which the country returns to a barter scenario, silver eagles would be a first choice as money.

It’s common knowledge inside the dealer community that the U.S. mint’s production capacity for silver eagles is poor. The US mint cannot keep its coin production in lock step with demand. During periods of high demand the US mint frequently sells eagles on allocation. This means the US mint has to limit each dealer to a specific quantity of silver eagles. Allocation relates to premium increases because buyers are willing pay large premiums for available inventory (also called “live” inventory).

I recommend not buying eagles when the mint is on allocation. Buying outside of allocation periods takes the pressure off buyers, because buyers don’t have to compete with other buyers for live inventory; it’s easier to acquire coins at low premium.

Silver 1oz Canadian Maple Leaf coins

Purity – 99.99%

IRA approved – Yes

Liquidity – High

1099B exempt – Yes

Comments:

The silver Maple Leaf coin is the Canadian brother to the American Silver Eagle coin. The Royal Canadian Mint (RCM) began minting maples two years after silver eagles in 1988. Comparable to the eagle, maples are 1099B exempt.

Thanks to the RCM’s record of minting high quality products they have become the second most popular mint in the United States. Silver maples are packaged in mint sealed tubes of 25 and are placed inside a RCM mint sealed “monster box” totaling 20 tubes. Each silver maple is minted “four nines” pure, as opposed to the more common 99.9% pure silver. In 2014 RCM added new security features to the silver maple. These include radial lines and a micro engraved privy mark on the reverse side of the coin.

Akin to the silver eagle, maples are highly recognized and reputable amongst silver dealers and individuals. In light of an economic crisis, maples would be an accepted barter coin.

The RCM occasionally experiences supply problems similar to the U.S. mint and will allocate a specific number of coins to wholesalers. However, the RCM is better than the U.S. mint at producing silver coins and fulfilling their quotas. Silver maple experience less supply issues and consequently its premium doesn’t fluctuate as much as silver eagles. This is clearly shown in the bid chart (compare the yellow maple line with gray eagle line in the bid chart above).

The obvious advantage to silver maples have over silver eagles is its lower premium. Why are maples less expensive than silver eagles if they’re so great? The answer is simple. The RCM charges less than the U.S. mint, that’s it. This means more silver for the buyer’s dollar.

As mentioned in my earlier comments on silver eagles, I recommend not buying maples when the RCM mint is on allocation.

“Junk Silver” 90% Silver Pre 1965 U.S. minted quarters, dimes and half dollars

Purity – 90%

IRA approved – No

Liquidity – Medium/High

1099B exempt – Yes when selling under 715 ounces ($1000 face of 90% Junk)

Comments:

Junk silver is the least sold product amongst the products listed in this overview, it’s also the least understood.

Junk silver is comprised of circulated dimes, quarters and half dollars dating 1964 and prior. Originally these coins contained 0.7234 ounces of pure silver per face value dollar (e.g. ten dimes / four quarters / two half dollars) in its uncirculated state. While these coins were in circulation a small amount of silver has been lost. The industry has compensated for the loss in silver by treating each face value dollar as 0.715 ounces of pure silver. This is why a standard $1,000 face bag of junk silver officially contains 715 ounces of silver instead of 723.4 ounces.

Since these coins are no longer minted by the US mint there is a limited supply. This limit creates unique periods of illiquidity. When the silver spot market experiences sudden nominal declines in price the coin industry experiences large increases in silver buying. The increase in buying clears all available supply for junk silver coins. When the supply dries, premiums explode (as shown in the bid chart in 2013 and late 2015), because wholesalers don’t have available inventory to match the high demand.

Unlike eagles, maples, bars and rounds, wholesalers can only acquire junk silver through the secondary market. The secondary market is made up of individuals and coin shops. Wholesalers have to offer high bids to convince individuals and coin shops to let go and sell their silver. This why the bid premiums can spike so easily. In the last 3.5 years the bids on junk silver ranged from as low as $0.75 under spot (6/4/2012) to as high as $3.75 over spot (9/18/2015). Given the average silver price for the last few years has been approx. $19.00, this means there has been a 24% swing in bid premiums!

Keep these historical bid premiums in mind when buying or selling junk silver (see orange line on bid chart). For example if the current offer for junk is $6.00 but the highest historical bid in the last three years has been $3.75, the buyer is looking at a minimum bid-ask spread of $2.25. Realistically the spread will be greater because few can sell at the exact top. On the other hand if the offer is $1.60 for junk silver the buyer can comfortably buy knowing they may one day sell at a higher premium or at least close to the original $1.60 offer.

Silver 1,000oz, 100oz, 10oz bars

Purity – 99.9% (occasionally 99.99% depending on the brand)

IRA approved – Specific brands are IRA approved: Pamp Suisse, Royal Canadian Mint, Republic Metals Corporation, Elemetal, Sunshine, Ohio Precious Metals, Johnson Matthey, Engelhard, Ashahi, Silvertowne

Liquidity – High

1099B exempt – Yes when selling under 1,000 ounces.

Silver bars, with exception to silver rounds, are the best way to have maximum silver ownership. Bars embody the phrase, most silver for your dollar. Naturally, the larger the denomination, the lower the price per ounce. For example, 100oz bars are less expensive than 10oz silver bars when looking at the price per ounce.

Silver bars are minted by almost every mint under the sun. Competition among the mints keeps supply high and the premiums low. Looking at the silver bar on the bid chart, represented by the dark blue line, one will see that silver bar premiums seldom fluctuate. When silver coins are on allocation and premiums are $4.00+ for silver coins I recommend buying silver bars.

Silver 1oz Rounds

Purity – 99.9%

IRA approved – Specific brands are IRA approved: Republic Metals Corporation, Elemetal, Sunshine,

Liquidity – High

1099B exempt – Yes when selling under 1,000 ounces.

Comments:

I believe my younger brother described silver rounds best when he said, “Rounds look like coins, but are priced like bars.”

Similar to bars, silver rounds are minted by various private mints competing on price, so the premiums are attractive. The premiums on 1oz silver rounds are so good that many times they are even better than most silver bars. At SchiffGold silver rounds are usually the same price per ounce as 100oz silver bars, and rounds are less expensive than silver 10oz bars. Given the option between a hundred of the 1oz silver rounds or one 100oz silver bar, I recommend the silver rounds almost every time. This is because the bids for rounds are better than the bars as seen on the bid chart above, compare the lighter blue line (rounds) with the dark blue line (bars).

Many clients ask, “Other than the price what is the difference between coins and rounds?” The answer is, coins are legal tender and rounds are not. While rounds are comparable in size, weight, shape, and purity, they are not legal tender because are minted by a private mints. Only national mints have the authority to mint legal tender coins.

When buying silver rounds I recommend buying the silver buffalo design. Silver buffaloes do not cost more than other designs, but they have a slight advantage during resale. Some dealers will pay $0.05 more for a buffalo round over another design. Why is this? For whichever reason the buffalo design has become the poster child for silver 1oz rounds and many buyers have come to prefer it over other designs.

Combining the mint detail and industry familiarity of the buffalo design with the low cost of private silver, buyers get the best of both words. Put differently, buffalo round buyers enjoy acquiring the most silver for their dollar, and a small denominational barter product that could be used in an economic meltdown.

Final Comments & Observations

Coins vs. bars/rounds

One of the most common questions I am asked is, “Which is better, coins or bullion?”

While I appreciate the value for both coins and bars, I recommend different products depending on the objectives of the buyer.

For buyers concerned with a dollar crisis, I recommend coins. Most of SchiffGold’s clients are coin buyers. This makes sense because physical silver buyers are seeking to eliminate third party risk with banks, brokerages and other financials firms. Coins buyers want to have a ready form of money if the dollar fails. Coins offer the best form of “insurance” from the most extreme forms of economic catastrophe.

If clients are seeking to simply minimize or eliminate third party risk but they are looking for an economical option to have maximum exposure to the silver price, I recommend 100oz and 1,000oz bars. Having more ounces of silver in the form of bars as opposed to having less ounces in the form of reputable coins may prove to be the better option in the long run. For example, if the silver spot price doubles, triples, or quadruples, then coin premiums by necessity must also double, triple and quadruple proportionally. If coin premiums do not move at least in tandem with the spot price then, all else equal, buyers would have been better off buying bars. I say “all else equal” because I would prefer to have reputable coins in my personal possession instead of a 1,000oz silver bar if the U.S. dollar was completely worthless.

Last but certainly not least, silver 1oz buffalo rounds are my recommended option for clients who want both an economical choice and want a reputable physical product for trading.

For more guidance on the ideal product to meet your specific needs speak with your precious metal specialist.

Silver Coin Market

As a precious metal broker I’ve noticed some market behaviors in the coin market. Silver coin buyers, tend to order most aggressively at both the top and bottom of the market. This is seen primarily with the eagle and maple coins. This gives an explanation to why the U.S. mint and RCM allocation periods coincide with silver spot price highs and lows. In 2011, when silver was trading at almost $50 an ounce the US mint was on allocation. Monster boxes were selling for over $25,000.00 apiece. The delivery delays ranged between 1-3 months. A comparable event happened during the fall of 2015, when silver was trading just below $14 an ounce.

It’s important to mention the benefits that mint allocation brings to those who own silver coins. Supply shortages offer potential spot price downside protection while simultaneously offering potential higher returns on the upside. For example, if the silver price plummets shortly after the purchase of silver eagles, then the buyer potentially benefits from a higher bid premium (again, this is seen in the bid chart in the months of September and October for 2015). High bids are also enjoyed when prices rise dramatically, such was the case in 2011 when the spot price rallied from $27.00 to almost $50.00 in only four months.

Junk silver coins are a different animal than the modern day coins like eagles and maples. Junk silver premiums seldom rise when the spot silver price increases. Outside of a few minor instances I could not find in my research a time when spot was increasing in tandem with junk silver premiums. In my opinion, this is a testament to the character of junk silver buyers, they are the classic “buy low, sell high”. They are hardly found when spot is relatively high, but they are the first to buy when silver makes new lows. This behavior combined with the very limited supply of junk silver coins creates the perfect storm for massive premium spikes, as seen on the bid chart (orange line).

Product Swapping

Lastly, when the bid is high enough such as in September and October of 2015, see graph, it may be wise for a silver owner to sell their coins and buy bars/rounds. Coins owners can sell their coins and then use the proceeds to immediately repurchase low premium silver bars and rounds. The net result to this exercise is more ounces of silver. While product switching might be advantageous it requires the correct execution. I recommend speaking with a SchiffGold precious metal specialist if you would like more information on this strategy.

Get Peter Schiff’s latest gold market analysis ñ click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!