American Pension Systems Looking Increasingly Greek

Could America go the way of Greece?

Most people don’t seem to think so. In fact, proposing that US policy could lead to a Greek-like meltdown will still elicit incredulous eye-rolls in most circles. But some of the structural problems that led Greece down her road to ruin already exist in the United States, especially when we look at state pension systems.

Greece has actually improved its pension system. It now ranks as the eighth worst in the world. That’s up from dead last. According to Eurostat, Greece spends 17.5% as a proportion of GDP on pensions, the most in the European Union. The size of the deficit in the pension system stands at 9% of GDP or $24 billion. On top of all that, as the Guardian reported, “pensions are now the main – and often only – source of income for just under 49% of Greek families, compared to 36% who rely mainly on salaries.” Those workers earning salaries ultimately have to support not only themselves, but the masses drawing off the indebted system.

Clearly, the burden placed on the Greek economy by this unsustainable pension system has contributed to the financial woes. Throw in a welfare state that discourages work, and you have a recipe for the economic meltdown we see playing out on the news today.

So, what does that have to do with the United States? Well, a close look at pension systems across the country reveals some troubling structural problems, and it looks Greek.

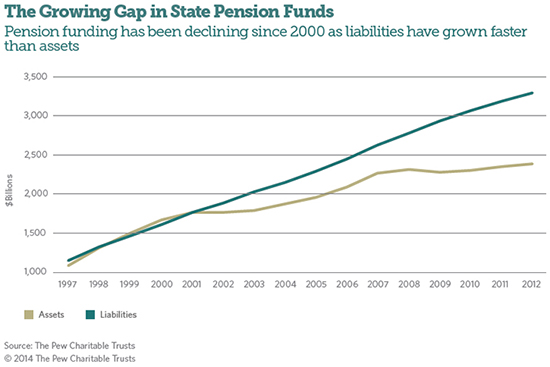

As CNN reports, a recently released report by Pew Charitable Trusts reveals the depth of the problem. Consider these facts.

- States are short $968 billion for their pension systems.

- The shortfall increased $54 billion in just one year.

- Including debts from local programs boosts the shortfall to over $1 trillion

- Three states — Illinois, Kentucky and Connecticut — have less than half of their pension programs funded.

Clearly this isn’t sustainable.

Some analysts believe the uptick in the stock market will reduce the shortfalls, but it seems pretty foolish to count on a stock market bubble that will eventually burst to save the pension system. In fact, odds are it will ultimately exacerbate the problem. Even if the stock market remains strong, it won’t be enough.

“State and local policymakers cannot count on investment returns over the long term to close this gap and instead need to put in place funding policies that put them on track to pay down pension debt,” according to the Pew report.

But politicians have proved over and over that they lack the political will to take the steps necessary to fix the system, and like the Greek people, Americans won’t stand for the hit their pocketbooks must take in order for states to make their pension systems solvent. It’s only a matter of time before these states come looking for bailouts.

The United States appears to be treading along a similar path as Greece. America hasn’t walked as far down the road, but all of the structural problems appear to be in place – underfunded pensions, an aging workforce retiring in increasing numbers and drawing more out of the system, fewer employed workers, and an ever expanding welfare state. And don’t forget the growing student loan bubble, which could leave future generations destitute and more dependent on government largesse than ever.

There may still be time to turn things around in the US, but central planners seem content to continue the same policies that led us to this point. We would all be wise to plan for the possibility of a Greek-style meltdown. One way to do that is invest in physical gold and silver. Precious metals historically hold their value and protect wealth in times of economic turmoil.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

We are now witnessing the death of Marxism. It will get increasingly ugly as time goes on.